Hello readers, here’s another end-of-the-month piece as we await the month of July. So far, there’s been a lot of heavy movements in the markets in recent times, and I can only hope we get to see more of this in the coming months. Presented in this article are my top 2 trade ideas for the month of July – I hope it helps!

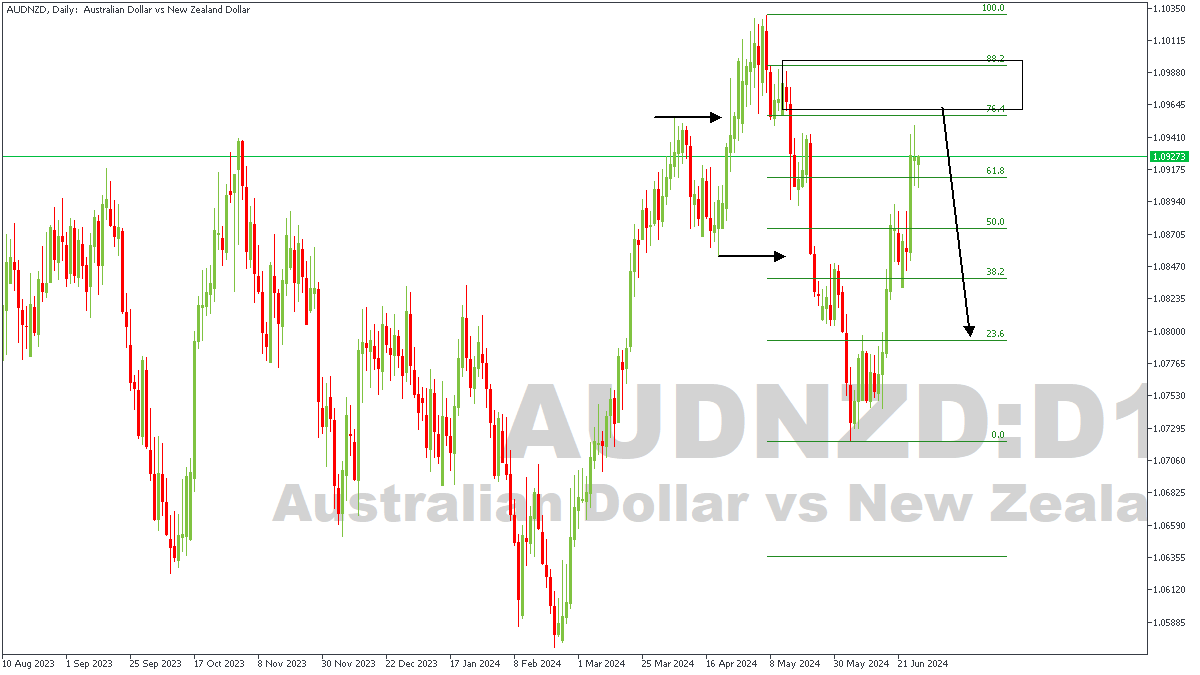

AUDNZD – D1 Timeframe

First, we see the daily timeframe chart of AUDNZD presenting a crucial SBR (Sweep-Break-Retest) movement, starting from the horizontal arrow to the left-hand side of the chart. Based on the break of structure, I have plotted a Fibonacci retracement tool in order to measure how soon the retracement is likely to end. My confluences for this trade include the Fibonacci retracement level, supply zone, and the weekly timeframe rally-base-drop supply.

Analyst’s Expectations:

Direction: Bearish

Target: 1.08427

Invalidation: 1.10107

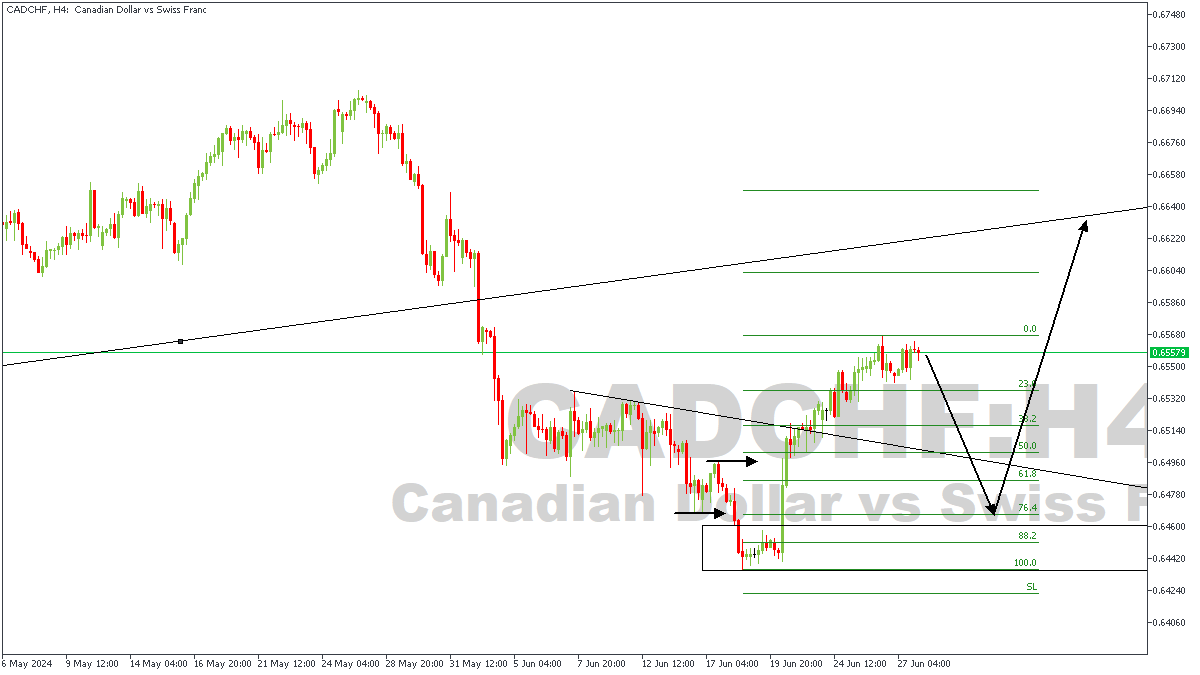

CADCHF – H4 Timeframe

On the Daily timeframe of CADCHF, we saw price make an initial bounce off the Daily timeframe demand zone in a move that broke both the previous structure, and the trendline resistance. Following this, I am anticipating a possible retest of the 4-hour demand zone within the daily timeframe demand zone, which will serve as my entry around the 88% of the Fibonacci retracement tool.

Analyst’s Expectations:

Direction: Bullish

Target: 0.66019

Invalidation: 0.64340

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.