European Central Bank (ECB) policymaker Olli Rehn stated on Wednesday that market expectations of the ECB reducing interest rates twice more this year, reaching 2.25% by 2025, are "reasonable," according to Bloomberg. The Finnish central bank chief emphasized the need to bring inflation back to 2% without significantly hindering economic activity. Following Rehn's comments, the EURUSD pair continued to face bearish pressure, nearing intraday lows of around 1.0710. His remarks have reinforced market sentiment that the ECB may adopt a more accommodative monetary policy stance. This has impacted the Euro, pushing it lower against the US Dollar – but for how long?

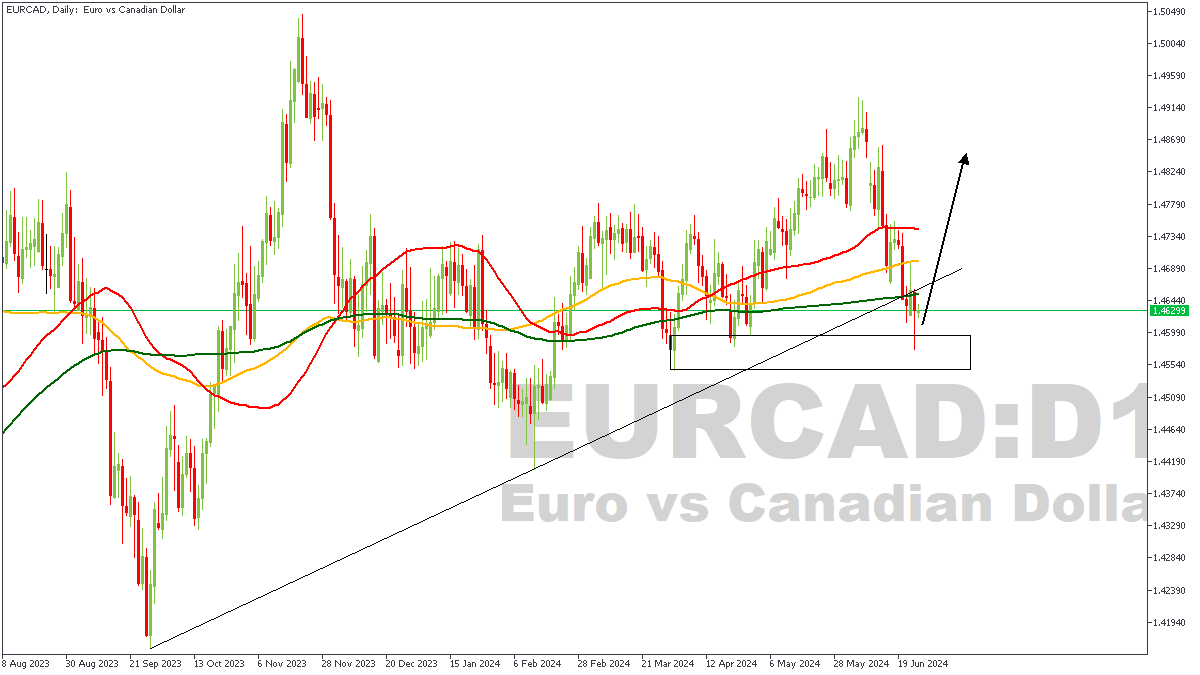

EURCAD – D1 Timeframe

The first thing that stands out evidently on the attached EURCAD daily timeframe chart is the trendline support, which at this time seems to be mounting ample pressure on the downward price movement. Secondly, we also spot a drop-base-rally demand zone, as highlighted by the rectangle, and the bullish array of the moving averages sends the message home. Worth noting is the fact that the demand zone lies snug within the target regions of our Fibonacci retracement tool.

Analyst’s Expectations:

Direction: Bullish

Target: 1.47152

Invalidation: 1.45441

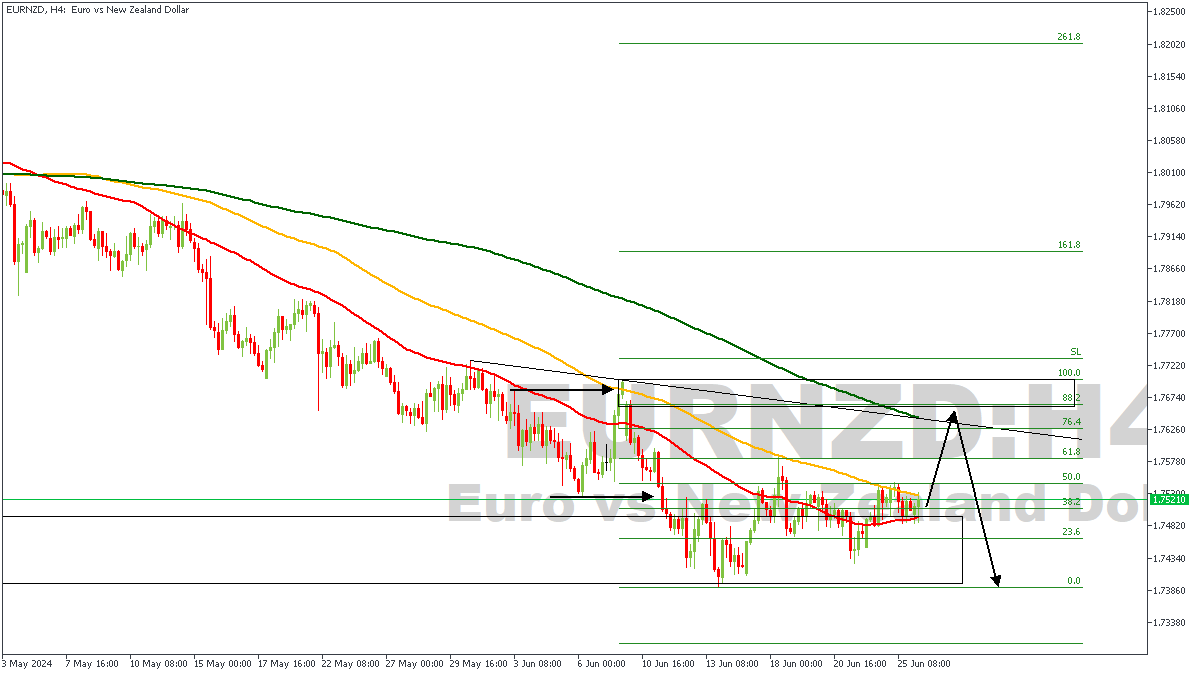

EURNZD – H4 Timeframe

Whilst the moving averages on the 4-hour timeframe of EURNZD seem to be in a bearish array, there also now is a trendline resistance that aligns almost perfectly with the slope of the 200-period moving average. There is also a QMR pattern on this chart, as seen from the sweep of the previous high, bearish break of structure, and now what seems to be a return to the order-block. The supply zone within the 88% region of the Fibonacci retracement zone is the final piece of the puzzle here. In the meantime, however, I will be looking to ride the bullish pressure of the return to the order-block move.

Analyst’s Expectations:

Direction: Bullish

Target: 1.76253

Invalidation: 1.74182

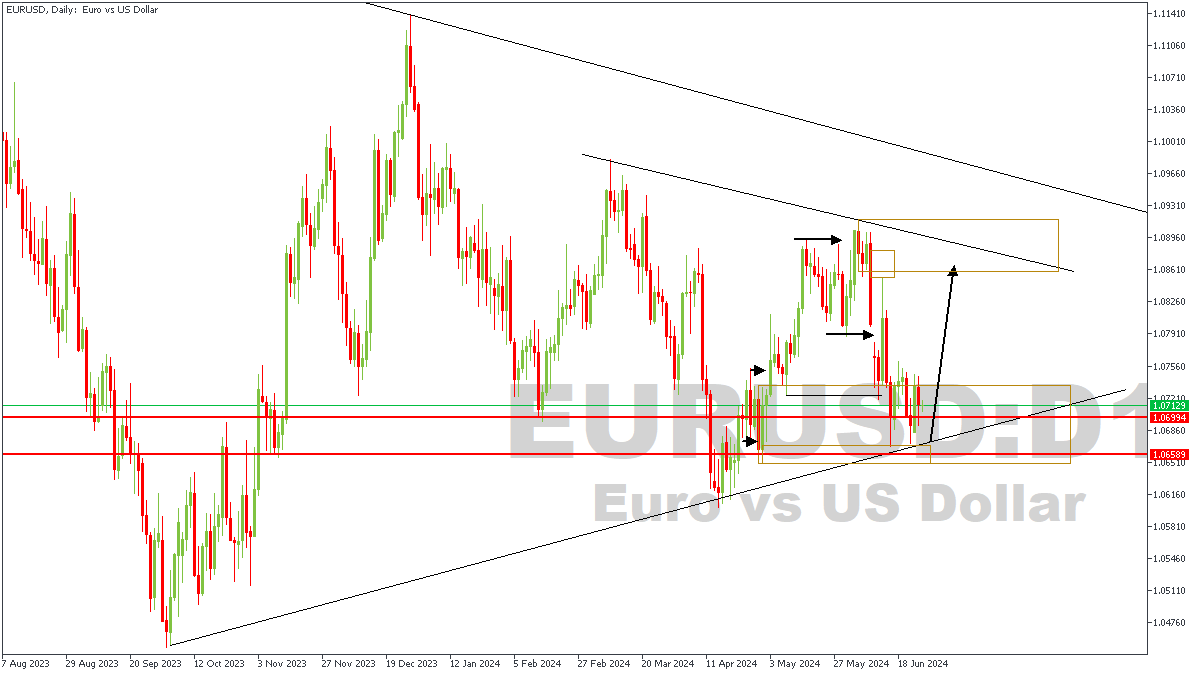

EURUSD – D1 Timeframe (RECAP)

Since my last article on USD Majors, the price action on the daily timeframe of EURUSD seems to have been stalling ever since. The invalidation region remains intact, we’re also yet to see any sweep of liquidity that might warrant the need to revise the trade idea – so, we remain committed to the bullish sentiment unless the lower timeframes fail to present a worthy entry criterion.

Analyst’s Expectations:

Direction: Bullish

Target: 1.07812

Invalidation: 1.06463

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.