Today, the CPI figures came out with quite a bang, yielding over 100pips movement across multiple pairs – the movements interestingly mirrored our expectations from the market review session on Monday. The figures from the May CPI report showed a positive trend with core CPI rising by 0.16% and median CPI estimated at 0.25%, marking the best figures since last summer. Core goods inflation decelerated to -1.7% year-on-year, though this trend may not continue. Core services inflation remained steady at 5.3% year-on-year. The disinflation was largely driven by declines in new car prices, apparel, durable goods, and education and communication commodities. Let’s see now how the markets are appearing ahead of the FOMC report in a few hours.

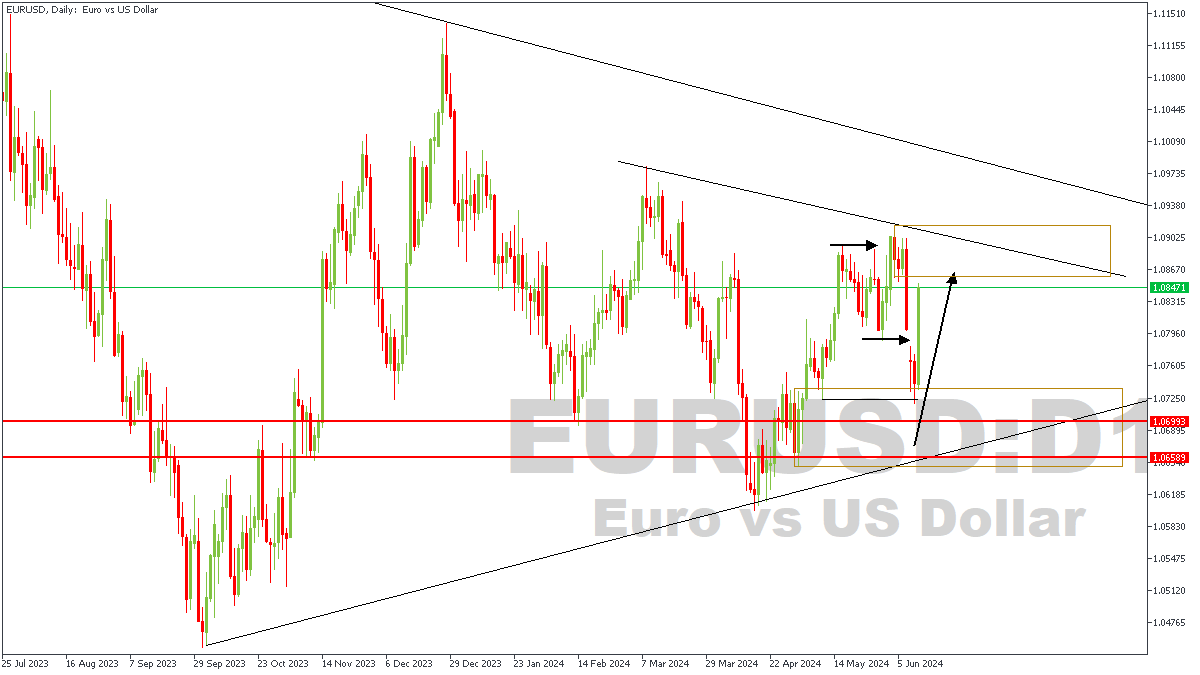

EURUSD – D1 Timeframe

On the Daily timeframe of EURUSD, we see price break below the previous low after having swept liquidity from the previous swing high. This movement as I’ve explained several times in the past is what is called a QMR pattern. In line with this, we see the trendline resistance lying on top of the supply zone from the right shoulder of the Quasimodo. This is my cue for a bearish sentiment on EURUSD.

Analyst’s Expectations:

Direction: Bearish

Target: 1.07033

Invalidation: 1.09163

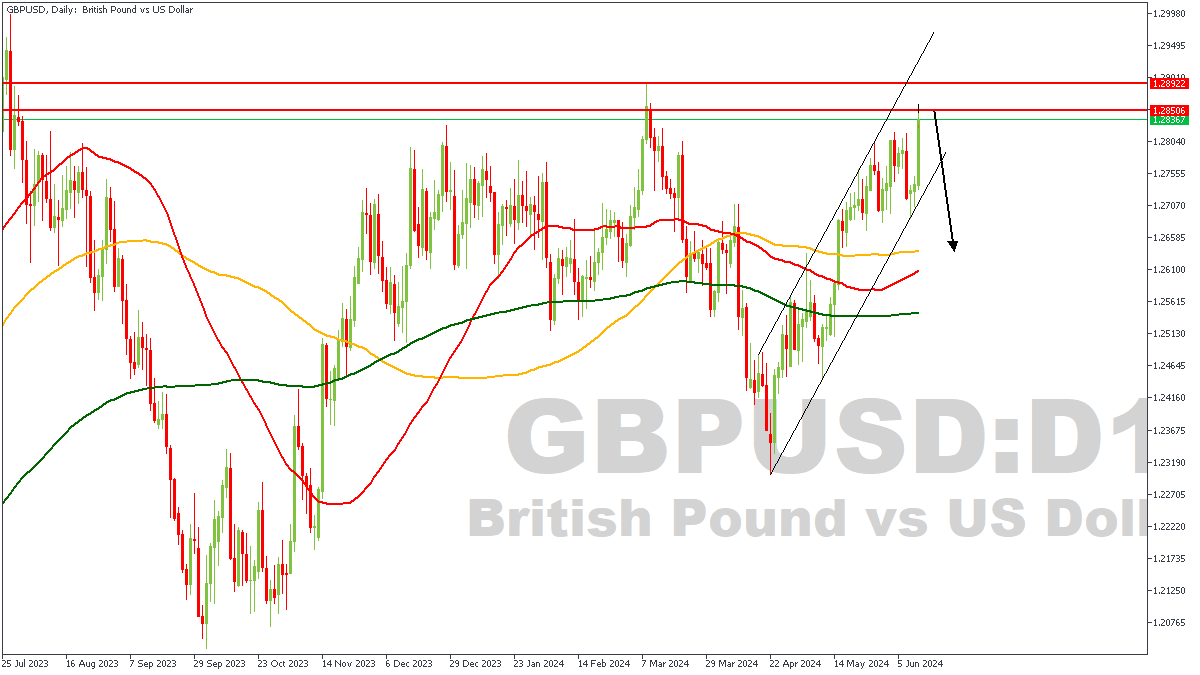

GBPUSD – D1 Timeframe

On the Daily timeframe of GBPUSD, we see price trading within a rising channel pattern, and approaching a supply zone. To the left of the most recent swing high, we can see that the swing high swept liquidity from the previous swing high, thereby creating a kind of Head-and-shoulder pattern. This could serve as a nudge for increased bearish participation in the market, and a very likely overall bearish outcome.

Analyst’s Expectations:

Direction: Bearish

Target: 1.27688

Invalidation: 1.28924

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.