Will the UK CPI send GBP Higher?

According to EY, profit warnings among UK-listed companies have reached levels last seen during the financial crisis, excluding the pandemic. More than one in six firms issued profit warnings in the past year due to rising borrowing costs and tightened consumer spending, impacting their margins. Insolvencies in June were 27% higher than the previous year and above pre-pandemic levels, with consumer industries like retail and hospitality being hit the hardest. The Bank of England's consecutive interest rate hikes, now at 5%, have added pressure on businesses and households with loans. If inflation figures released on Wednesday fall by less than expected, another sizable interest rate increase of 0.5 percentage points could be in August. These challenges are also spreading to larger companies, with earnings downgrades impacting firms with revenues of £200m-£1bn.

GBPUSD - D1 Timeframe

GBPUSD is, at this time, trading within a rising channel, with the most recent reaction coming from the trendline resistance and heading towards the trendline support with the intent to give off a reaction. To the best of my knowledge, and based on the price action, I expect the price to reach the support area before a likely bounce to resume the uptrend.

Analyst’s Expectations:

Direction: Bearish

Target: 1.28444

Invalidation: 1.29880

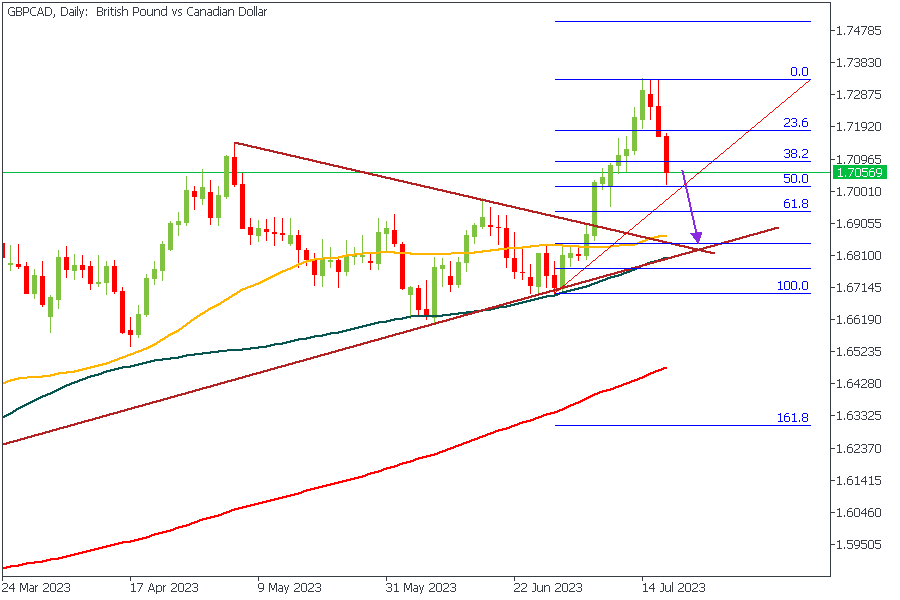

GBPCAD - D1 Timeframe

Looking at this, GBPCAD might not seem like a good sell to many traders at the moment, but I strongly believe the current uptrend has lost its steam and would, with all likelihood, aim for the support trendlines and the moving averages to recover its upward momentum.

Analyst’s Expectations:

Direction: Bearish

Target: 1.68690

Invalidation: 1.71028

GBPAUD - D1 Timeframe

GBPAUD is in a tricky spot. The weekly timeframe indicates that the price has reached a major supply zone with an initial rejection from that zone, and the daily timeframe also adds up as a confirmation of that tune. The clause here, however, is to patiently wait for the price to cross the short trendline I have marked, which I expect would be the onset of the bearish movement to the trendline support at the demand zone.

Analyst’s Expectations:

Direction: Bearish

Target: 1.87396

Invalidation: 1.92699

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.