Will The ECB Support EUR?

Core inflation has improved recently, but the ECB is cautious due to fluctuating oil prices that could rekindle headline inflation. Another ECB interest rate hike is viewed as unlikely at present. Monetary data, economic indicators, and wage growth suggest a more stable underlying inflation trend. In light of this data, it seems prudent for the ECB to pause further rate hikes. Leading experts also propose that current interest rates are sufficiently restrictive. Furthermore, the Commonwealth Bank of Australia and the National Australia Bank, among others, anticipate no interest rate adjustments, consistent with the ECB's stance that rates have significantly contributed to inflation control. While discussions regarding the end of the Pandemic Emergency Purchase Program (PEPP) may arise, a decision in this regard is not expected until early 2024.

EURGBP - D1 Timeframe

From the chart, we see that price is currently at a supply zone on the daily timeframe of EURGBP. There are also other confluences pointing to the likelihood of a bearish move, including; a trendline, and a moving average resistance.

Analyst’s Expectations:

Direction: Bearish

Target: 0.86509

Invalidation: 0.87444

EURNZD - D1 Timeframe

The price action on EURNZD is a bit tricky but the market structure is quite clear - price broke below the previous low before reacting at the trendline support. This means we can now consider the market to be in a bearish trend. The current zone is a supply zone that I believe will provide the final confirmation of the change in market sentiment.

Analyst’s Expectations:

Direction: Bearish

Target: 1.78455

Invalidation: 1.83173

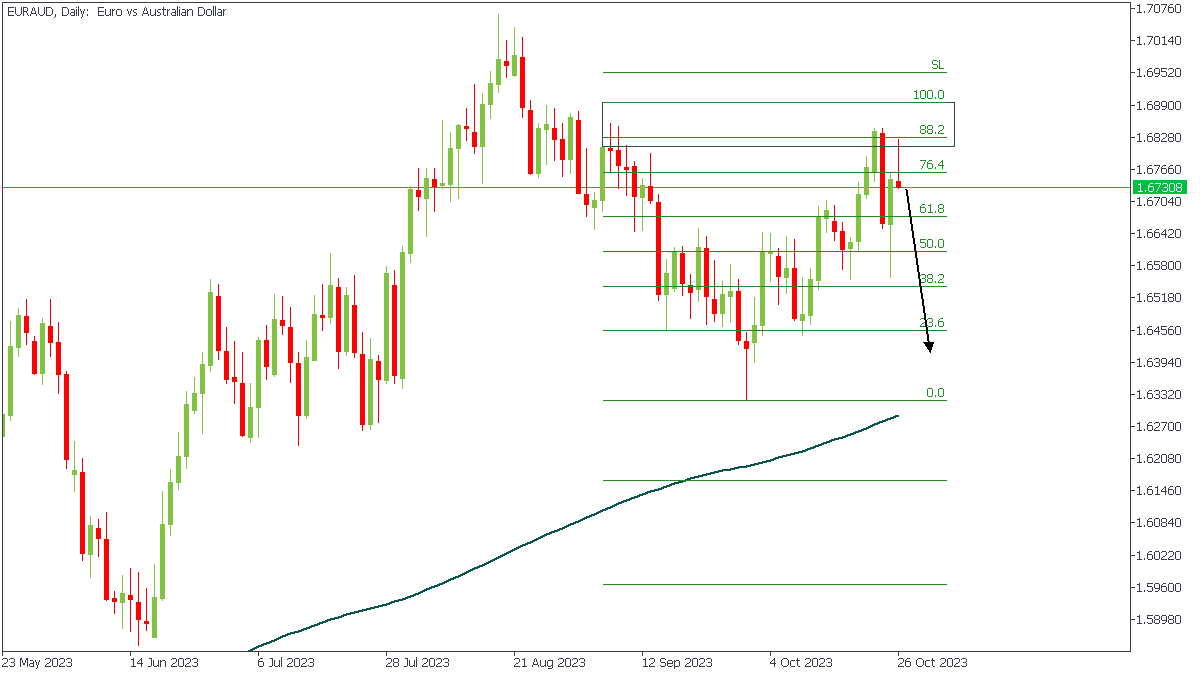

EURAUD - D1 Timeframe

EURAUD on the daily timeframe is currently reacting from the 88% Fibonacci retracement level, and could be heading towards the 200-day moving average as its target. This is not based on speculations, but rather the market structure; we see a bearish break of structure, a Quasimodo pattern, as well as the Fibonacci retracement level.

Analyst’s Expectations:

Direction: Bearish

Target: 1.65490

Invalidation: 1.68700

CONCLUSION

The trading of CFDs comes at a risk. To succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.