Will Disney survive amid coronavirus?

The company’s stock declined hugely, but Disney+ can offset some part of it. We will know the true picture on May 5 after its earnings report.

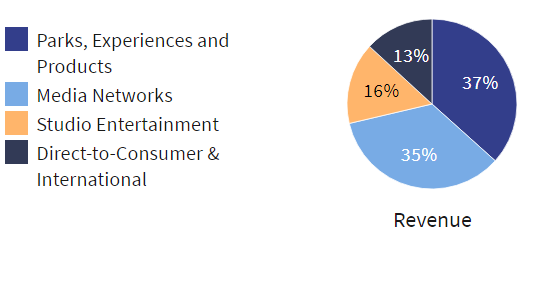

The largest part of the Disney’s revenue comes from parks, experiences, products and studio entertainment, that are not available because of the current lockdown. However, third of its revenue is provided by Media Networks. Its successful Disney+ streaming service can save the corporation from the dramatic fall. This service got 50 million subscribes in March due to entering to European and Indian markets before the shutdown. These days social distancing and stay-at-home regime can boost the amount of subscriptions. It's easy to believe that Disney+ can approach Netflix numbers. If it does that, it may double the size of any other segment in the corporation.

Anyway earnings will be damaged by the coronavirus pandemic. Let's look at this another way, it’s a good entry point to the Disney stock. Theme parks will soon reopen as many US states have started to ease their lockdowns. The state of Florida has already released guidelines for how Disney World can safely come back to work. So, if the pandemic ends sooner than we expect, the Disney stock will ramp up even without the help of Disney+. However, the recovery won’t happen immediately, it will take a long time.

Let’s see where is the Disney stock price now and where it is headed. The price declined from 148.00 to 80.00 at the beginning of the lockdown, but then it rebounded about 50% from their recent low. Now the price is climbing up. We can see that the 50-day moving average has crossed the 100-day moving average bottom up, what is a signal to buy. Resistance line is 121.00. Support lines are 105.00 and 95.00.