Virgin Galactic Offers Long Trade Opportunity

Is it time to buy?

Virgin Galactic's stock price dropped by 50% after its first fully crewed flight carrying its founder, Richard Branson.

There are a couple of factors driving the decline including the company’s move to sell about $500 million in the stock a day after the test flight, and rival Blue Origin’s successful crewed rocket ship launch in mid-July. Moreover, investors are likely looking beyond Virgin’s test flights to its commercial flying timeline, which is likely at least one year away. We think that the recent drop might be a good buy opportunity for several reasons.

The successful flight proved the beginning of a new space era. The community has become more confident that Virgin Galactic is not a start-up anymore. Moreover, the company raised the flight price from $250.000 to $450.000 which proves their confidence in future demand.

The space flight sector is still in its early stages. Also, the main competitors Blue Origin and Space X develop deep space flights and leave Virgin Galactic the only company in the space tourism sector.

Technical analyses

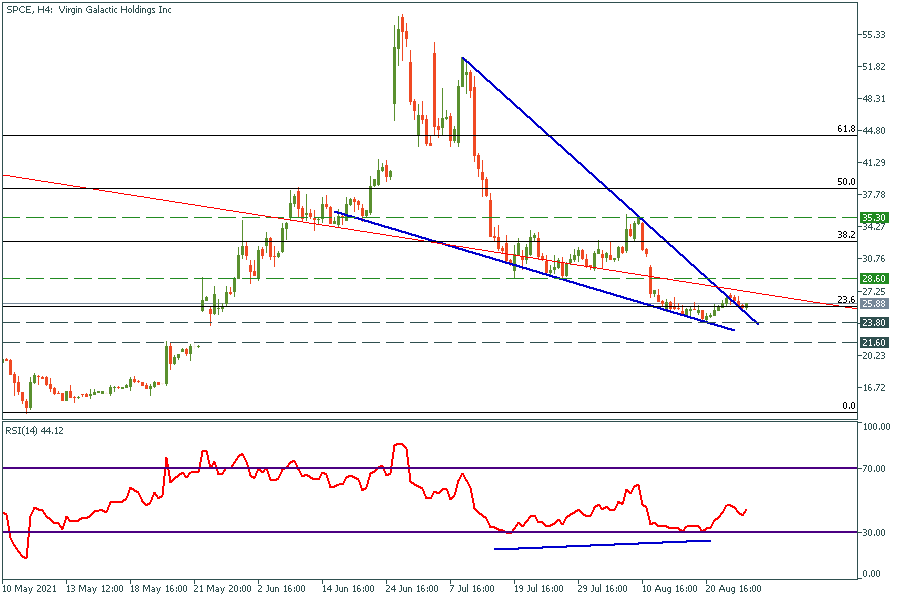

4H chart

Virgin Galactic stock price has formed a bullish “falling wedge” pattern with a small RSI divergence. According to this situation, the main target is $28.6. If the price breaks this level we might see Virgin Galactic worth $33 shortly.

On the other hand, if the price doesn’t hold the $23.8 support level, the way to $21.6 will be open.