USD: CPI Sets The Tone For Further Movements

The US Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) in the US increased to 3.2% year-over-year in February from 3.1% in January. The Core CPI, which excludes volatile food and energy prices, rose 3.8% year-over-year, slightly below January's 3.9% but above market expectations of 3.7%. Both the CPI and Core CPI also rose by 0.4% on a monthly basis. The increase was mainly attributed to rising shelter and gasoline prices, which contributed over sixty percent of the monthly rise in all items. The energy index rose by 2.3% over the month, while the food index remained unchanged. In response to the CPI data, the US Dollar Index saw a slight increase, rising 0.08% on the day to 102.93.

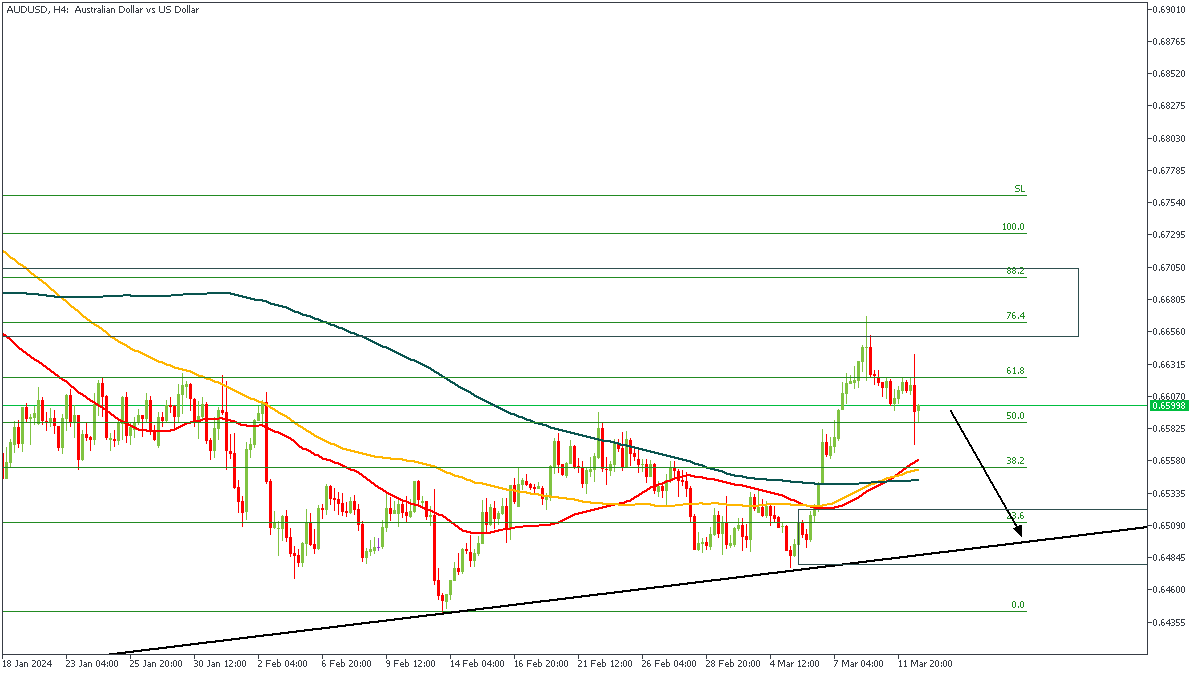

AUDUSD - H4 Timeframe

The AUDUSD chart on the 4-hour shows price currently reacting away from the supply zone, which overlaps fittingly with the 76% of the Fibonacci retracement zone. Also, we see that there is a trendline support below the current price action, as well as a demand zone. Following these confluences, I find it appropriate to maintain a bearish sentiment until price reaches the demand zone to react from.

Analyst’s Expectations:

Direction: Bearish

Target: 0.65216

Invalidation: 0.66723

EURUSD - H4 Timeframe

On the 4-hours timeframe, EURUSD has just broken out of the wedge consolidation pattern and could be heading towards the 200-period moving average as its initial target. In the meantime, however, I expect to see prices slide lower till it finds support from the moving averages or the Fibonacci retracement level.

Analyst’s Expectations:

Direction: Bearish

Target: 1.08575

Invalidation: 1.09559

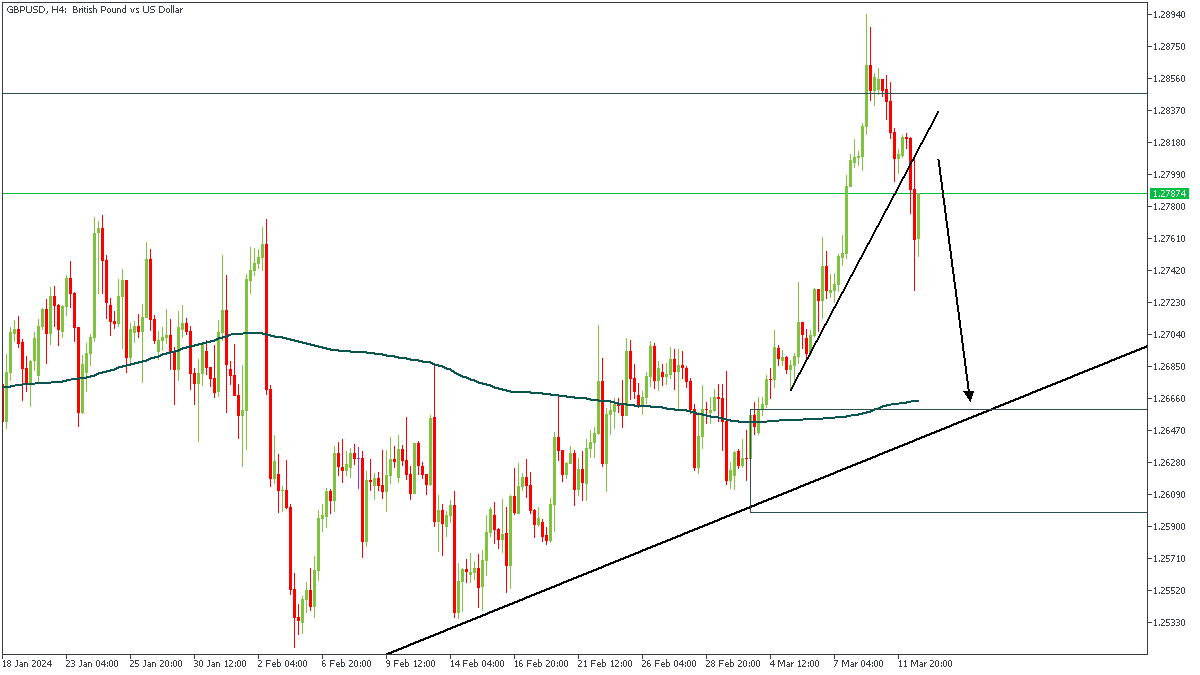

GBPUSD - H4 Timeframe

The recent rejection from the supply zone on the 4-hour timeframe of GBPUSD has been observed to break the trendline support; following this, I see the likelihood for price to continue its drop until it reaches the confluence of the trendline support and the 200-period moving average. This is my sentiment in the meantime, although the overall structure seems to have shifted.

Analyst’s Expectations:

Direction: Bearish

Target: 1.26870

Invalidation: 1.28396

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.