USD: CPI Carries The Dollar to Pivots

The higher-than-expected inflation data for January has reignited concerns about rising prices and its implications for Federal Reserve policy. While investors had anticipated rate cuts in the near term, the hot inflation print may delay such actions. As the Fed navigates the delicate balance between containing inflation and supporting economic growth, market participants will closely monitor future inflation reports and Fed communications for further insights into monetary policy direction.

EURUSD - D1 Timeframe

The price action on the Daily timeframe of EURUSD has reached a crucial zone, as shown by the overlapping of the trendline support and the demand zone which come together to provide ample confluence for the bullish sentiment to play out. Here, I expect to see price retest the previous high before any further decline in prices.

Analyst’s Expectations:

Direction: Bullish

Target: 1.07717

Invalidation: 1.06511

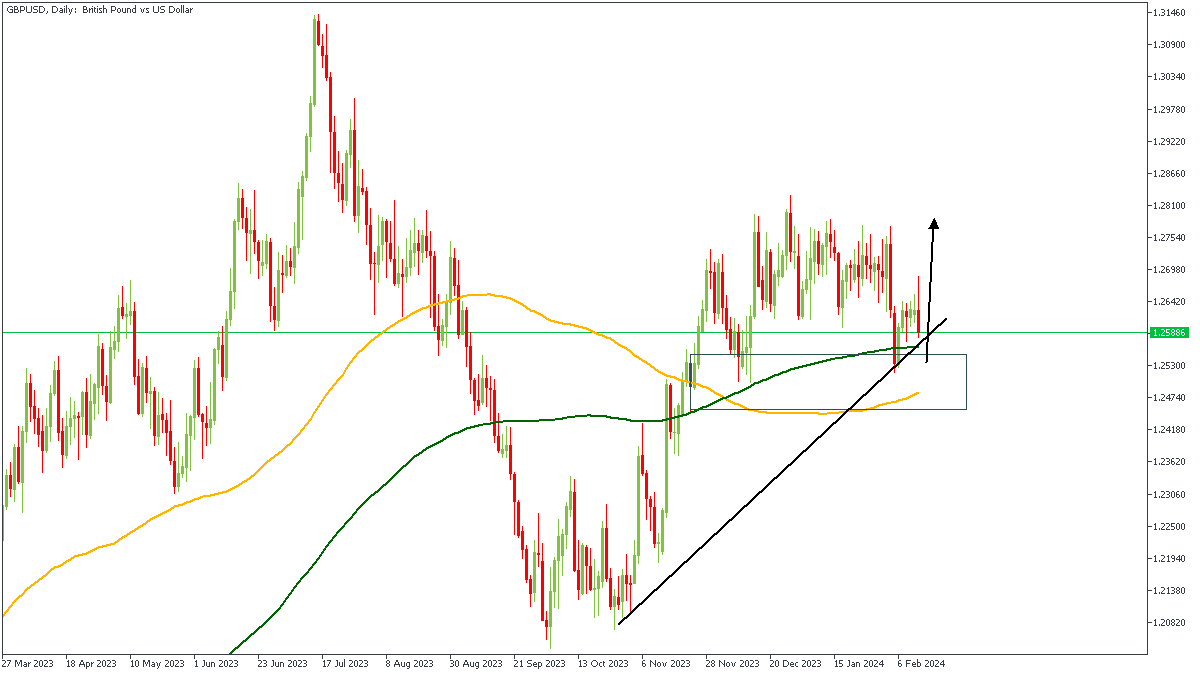

GBPUSD - D1 Timeframe

Asides the 100 and 200 period moving averages that are expected to serve as support areas for the price action on GBPUSD, we also see the demand zone on the daily timeframe currently being retested. At the moment, the most logical expectation from this is a bullish sentiment, since the trendline support can be considered another major confluence.

Analyst’s Expectations:

Direction: Bullish

Target: 1.27359

Invalidation: 1.24482

AUDUSD - D1 Timeframe

The current price action on the Daily timeframe of AUDUSD is sitting on the 76% of the Fibonacci retracement of the initial bullish move that broke structure. Following this, price also formed a trendline support, which provides further arguments in favour of the bullish sentiment.

Analyst’s Expectations:

Direction: Bullish

Target: 0.66641

Invalidation: 0.63318

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more trade ideas and prompt market updates on the telegram channel.