US Dollar Losing Further Ground

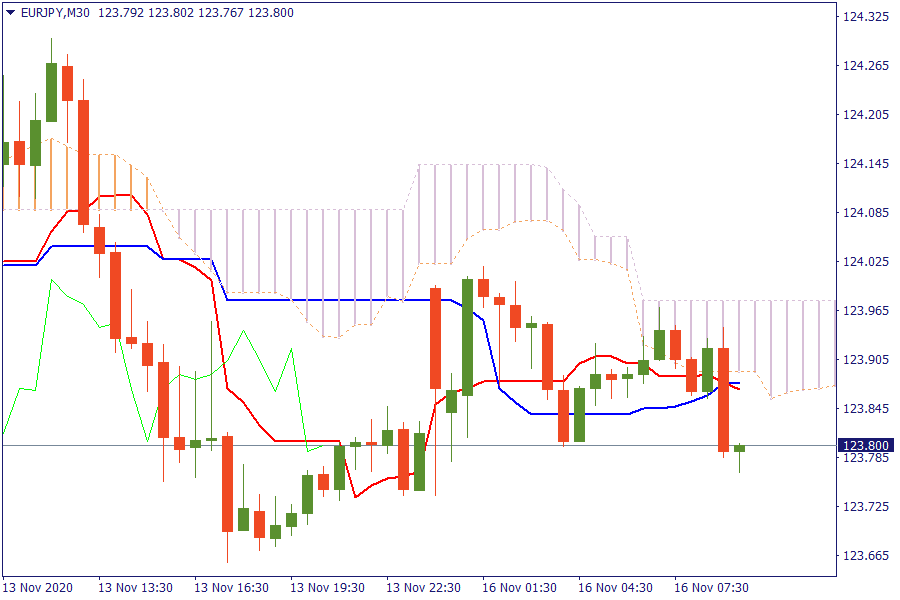

Ichimoku Kinko Hyo

EUR/JPY: The pair is trading below the cloud. A downward pressure would lead the pair to exit further the cloud, confirming a bearish outlook.

Fibonacci Levels

XAG/USD: Silver after a remarkable sell off last week is trading higher between 50% and 61.8 retracement area.

EU Market View

Asian equities hit a record high on Monday as investors set aside fears about rising coronavirus cases and bought stocks, cheered by data showing a robust recovery in China and Japan. There are just mountains of cash sitting on the sidelines and big hedge funds know it. Japanese economic growth, which beat records and forecasts to pull the world's third-largest economy out of recession and better-than-expected industrial output in China added to the enthusiastic mood. Investors are suddenly more optimistic on the global economic outlook after upbeat news on the Pfizer vaccine early last week. The vaccine breakthrough ignited a rally in the riskiest assets around the world. EU sources noted there was less progress in recent days on outstanding Brexit sticking points than they had hoped for.Looking ahead, highlights from macroeconomic calendar include US NY Fed Manufacturing, RBA’s Lowe, Fed’s Clarida and Daly, ECB’s Lagarde, de Guindos and Mersch speeches.

EU Key Point

- BOJ's Masai supports that ETF purchases, forward guidance will remain part of our toolkit

- ECB president Lagarde to speak later today

- Germany reports 10,824 new coronavirus cases in latest update today

- China data shows new jobs created from Jan to Oct, reached the annual target ahead of schedule