TRADE IDEA: Major Currency Pairs to Watch Out For This Week

It is general knowledge that the Major currency pairs are pairs that have the US Dollar as either the base or quote currency. As a result, our trade ideas for major pairs will begin first with an analytical review of the US Dollar chart.

As you can see from the chart above, the US Dollar on the Daily timeframe has broken below the 100-Day Moving Average and is expected to reach the 200-Day average as its next target. We also observe the presence of a solid drop-base-rally demand zone resting within the region of the MA. This implies that we can expect a temporary weakness in the Dollar until price reaches the expected area of interest. With the incoming release of the PPI and Empire State Manufacturing Index on Tuesday, I personally will be expecting the figures to favour the Dollar.

EURUSD

The Daily timeframe on EURUSD presents a clear selling opportunity from the retest of the 200-Day Moving Average as well as the drop-base-drop supply zone occurring within the range. It is also noteworthy that we have seen a tentative grab of liquidity right before price taps into our area of interest.

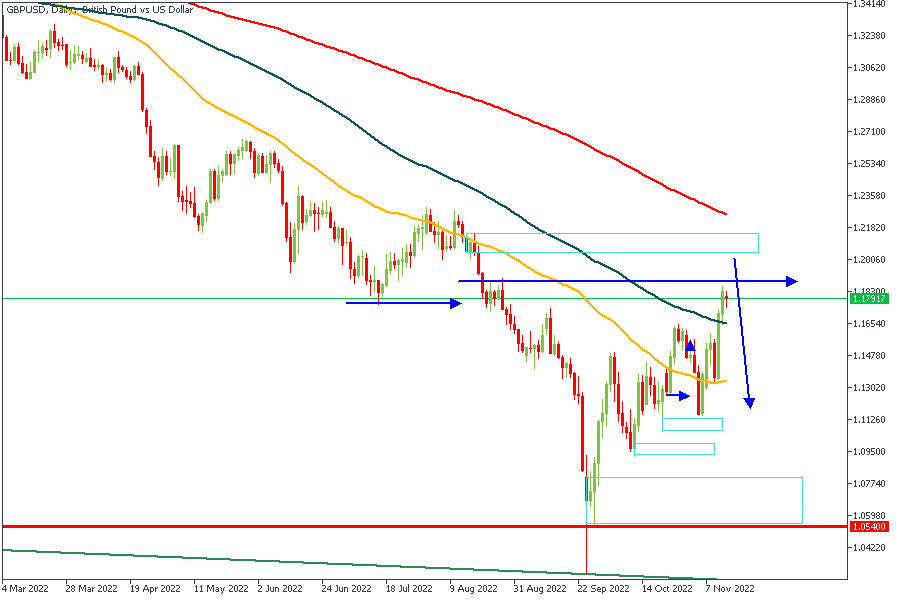

GBPUSD

This week I am expecting GBPUSD to continue its downward trend from the 200-Day moving average. Price will most likely tap into the drop-base-drop supply zone after taking out liquidity from the high marked by the arrowed line. The PPI figures should contribute some volatility to help this play out smoothly.

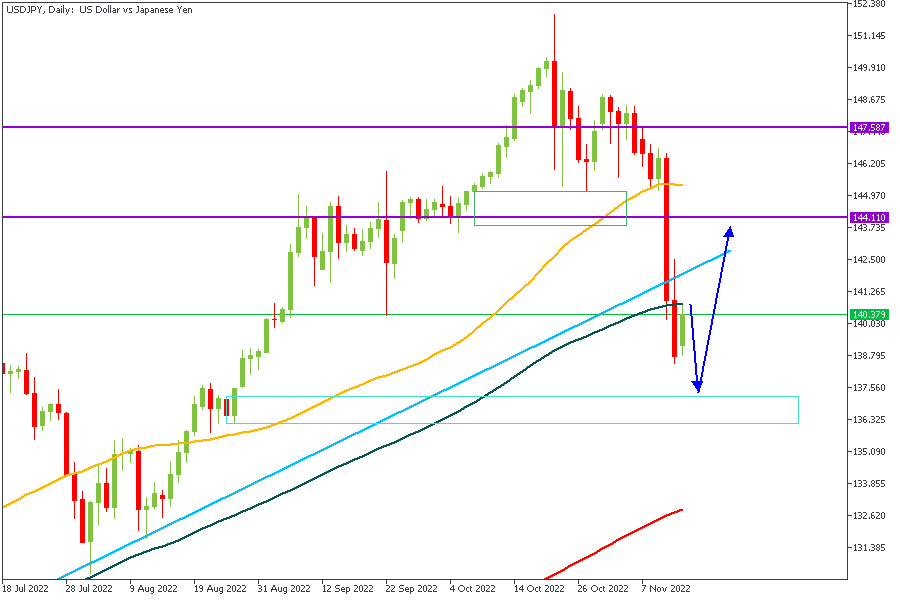

USDJPY

USDJPY broke below the 100-Day Moving Average and created a divergence. This signifies an impending change of direction which will likely commence from the rally-base-rally demand zone marked by the hollow rectangle. The bias is bullish for the time being once the reaction from the demand zone has been confirmed.

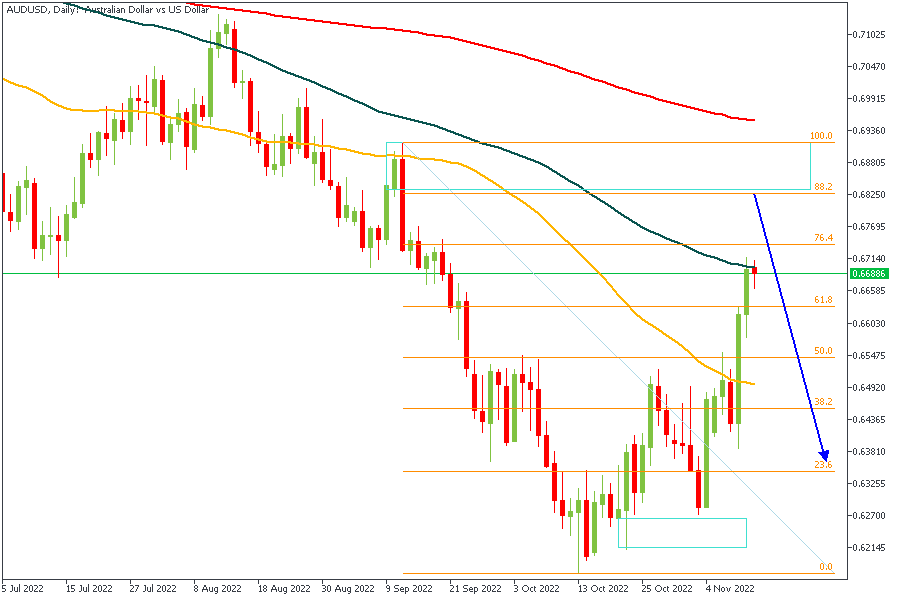

AUDUSD

Even though price is currently trading at the 100-Day moving average, the momentum suggests a likely break above the MA in order to create a divergence and also give room for price to recover the imbalance between the 76.4% and 88.2% of the Fibonacci retracement. Once this move has been completed, I will be looking for opportunities to short the market.

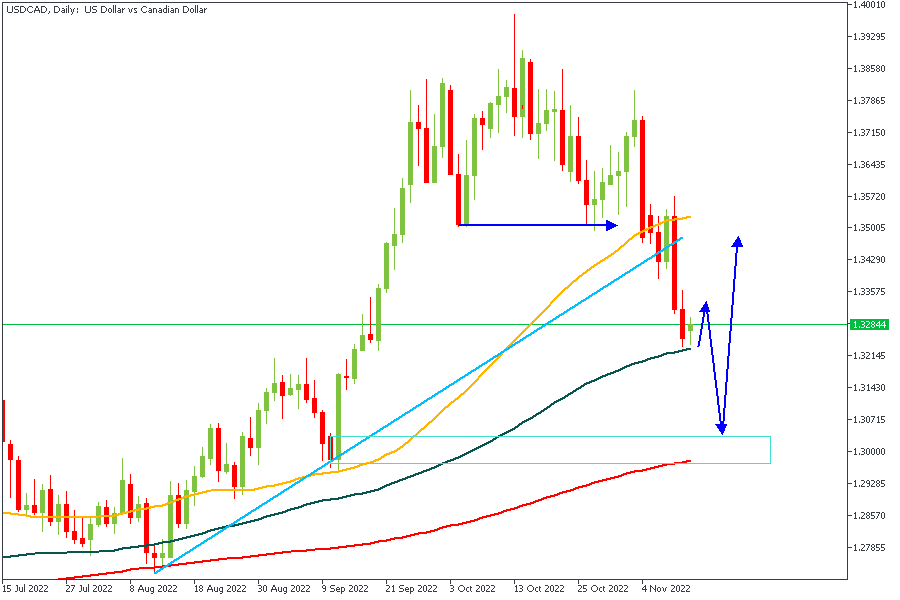

USDCAD

My expectation from USDCAD can easily be interpreted from the arrow directions. To break it down, however, I am anticipating a sleek drop in prices to the 1.30300 regions for a solid rejection from the drop-base-rally demand zone, and the 200-Day Moving Average confluence.

CONCLUSION

It is important to understand that the trading of CFDs comes at a risk; if not properly managed, you may lose all of your trading capital. To avoid costly mistakes while you look to trade these opportunities, be sure to do your own due diligence and manage your risk appropriately.

Log into your dashboard or create an account here to get started.