The Magnificent Seven. What's pulling the US indices up?

The S&P500 Index has been rising for the last four months of the current year. Over the past quarter, the index gained 3.85%. Bulls almost managed to break through the mark of 4300 points. And yet there are some doubts about the continuation of further growth. What's going on?

Market breadth

Market breadth is the number of stocks that went up relative to the number that went down. The growth of the index is not enough, right? Remember at least the history of the Finnish stock exchange, on which Nokia shares took the most significant part of the index (more than 70%). Thus, the rise/decline of the Helsinki Stock Exchange was enough for Nokia's capitalization to change enormously in one direction or the other.

You can measure the market breadth with the help of the Arms indicator - TRIN.

It turns out that the external bullish optimism on the US stock market hides a harsh truth - the Arms TRIN indicator is declining. It has not yet reached the oversold zone (below 0.5) but if it reaches this zone - the stock market will be considered extremely overbought.

Of the 503 stocks included in the index, only 236 rose during the past quarter. The rest of the stocks declined.

At the same time, most of the stocks that rose have the most weight in the index, leading to a substantial rise in the stock.

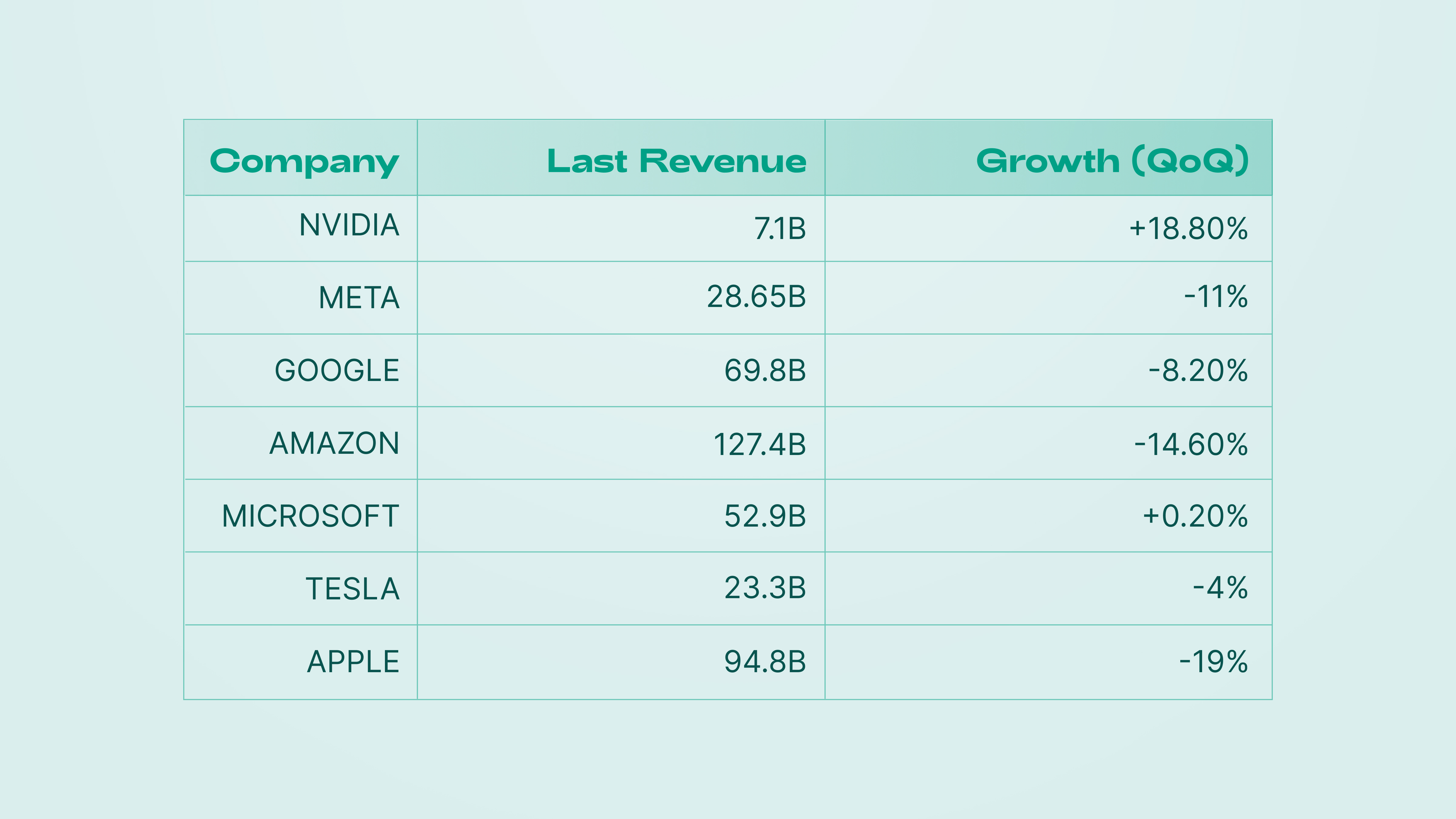

Shares of Nvidia (up almost 55% over the quarter), Meta (+42.5%), Google (+29.97%), Amazon (+29.08%), Microsoft (+27.47%), Tesla (+23.39%) and Apple (+16.32%) rose the most over the past quarter.

These companies have been dubbed the Magnificent Seven.

Reasons for the growth of the seven.

AI hype was the first and perhaps the main reason for such a rapid takeoff.

The current AI trend involves three companies - Nvidia, Microsoft, and Google.

As of June 2023, the Chat GPT query ranks 78th in Google's Global Search.

How significant is hype's contribution to the stock market's growth? It's hard to estimate. However, we assume that up to about a quarter of the total increase in capitalization, the above companies owe the AI hype.

The reporting was the second reason for the strong growth of the capitalization of the seven.

Even though, in comparison with the 4th quarter, the earnings of almost all companies decreased, the reports of all seven surpassed expectations and triggered further growth.

The third reason was the cuts announced by the companies, which should positively affect lower OPEX and the growth of the company’s net profits.

Four of the seven companies are planning significant layoffs: Meta is cutting 100,000 people, Google 12,000, Amazon 18,000, and Microsoft 10,000.

How badly are the stocks "overbought"?

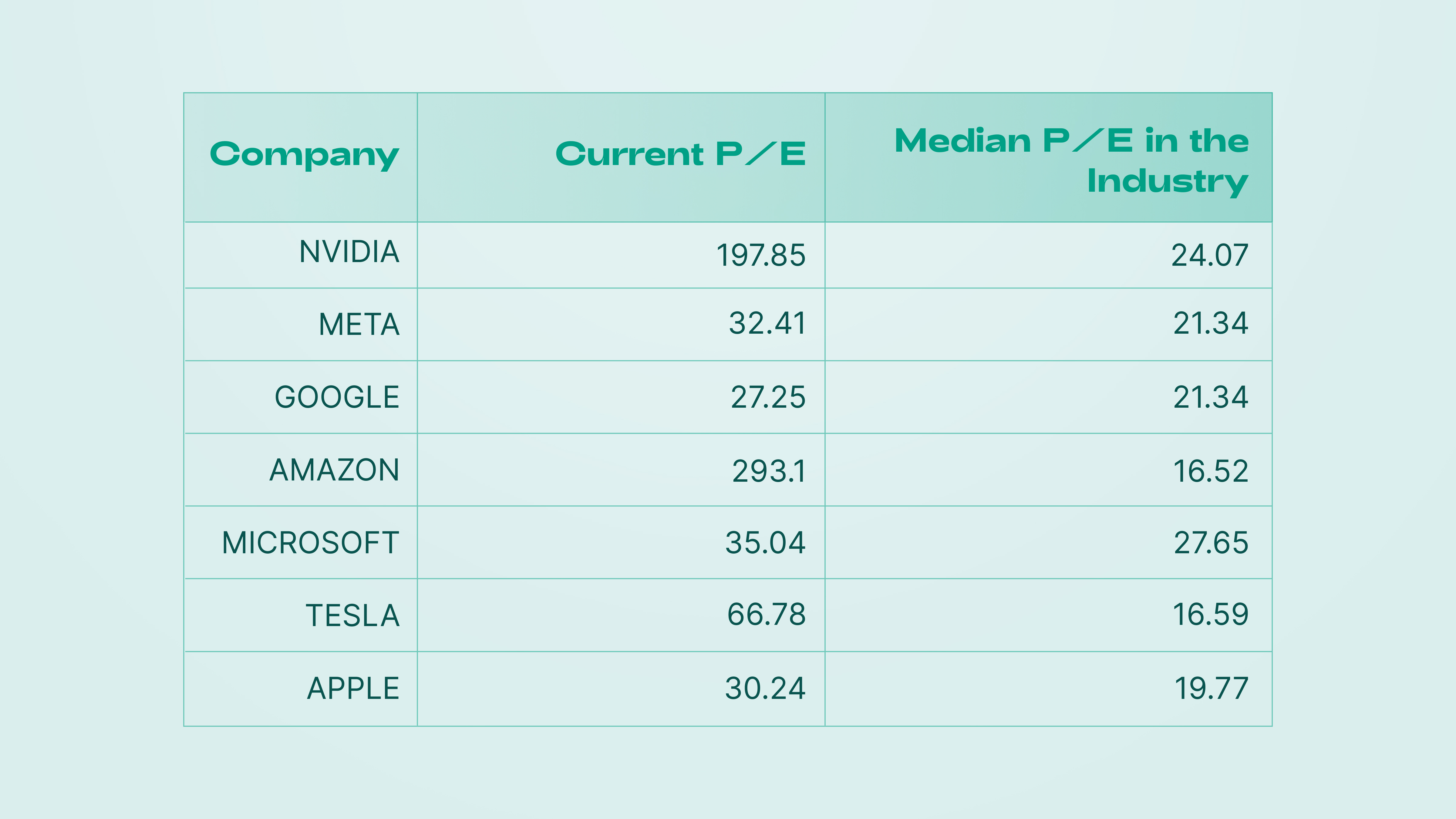

The overbought nature of the securities can be assessed using the classic P/E ratio. Here, however, it should be taken into account that growth stocks, which include the seven stocks, should have a high P/E.

As you can see, Nvidia and Amazon have insane P/E ratios. The payback period of investment in the business of these giants will be 200 to 300 years. There is a clear bubble.

Tesla has a high P/E - 4 times higher than the industry median.

The other companies (Apple, Microsoft, Google, and Meta) have a higher P/E ratio than the industry, but it looks normal.

What to do with the Magnificent Seven?

The most optimal positions right now are shorts on the magnificent seven, except for Tesla, perhaps.

From a purely technical point of view, Tesla shares still have upside potential despite a high P/E.

It is essential to remember that short positions are always quite risky, so it is necessary to be very careful when opening such positions and use stop losses when opening trades.

Conclusion

The rise in US indices is mainly unwarranted and based on partial AI hype and conviction of further US Fed rate cuts.

Alas, both hype and conviction of monetary easing can only have a temporary bullish effect on the market.