The January US CPI and Its Impact on EURUSD

Fundamental Outlook

Today, Tuesday, February 13th, at 8:30 am New York time, the Bureau of Labor Statistics (BLS) releases US inflation data related to the Consumer Price Index (CPI). This high-impact data could generate significant changes in the perception of the Federal Reserve's (Fed) monetary policy, likely triggering extreme volatility around the US dollar (USD).

Market Expectations

Expectations surrounding the upcoming report are clear: overall inflation in the United States is expected to increase at an annual rate of 2.9% in January, a slight deceleration compared to the 3.4% rise recorded in December. At the same time, the core CPI inflation rate, which excludes food and energy prices, is projected to decrease to 3.7% from 3.9% the previous month. On a monthly basis, a 0.2% increase is expected for the overall CPI and a 0.3% increase for the core CPI.

Adjustment of Previous Monthly Figures

The BLS also reported that it revised downward the December monthly increase in the CPI to 0.2% from 0.3%. On the other hand, the November CPI was revised upward to 0.2% from 0.1%, while October's growth remained unchanged at 0.1%. These revisions, according to the BLS, reflect new seasonal adjustment factors.

Factors That Could Affect the Figures

Richmond Federal Reserve Bank President Thomas Barkin warned on Monday that US companies accustomed to raising prices in recent years could continue to fuel inflation. Among other factors that could influence the inflation report, the 6% increase in oil prices due to concerns about a possible supply shock from the crisis in the Red Sea stands out.

Market Impact

Following solid labour market data in January, markets have adjusted their expectations regarding a possible change in Fed policy. Currently, at FBS, we estimate that the Fed will only make 3 or 4 rate cuts starting in the summer, considering bank officials' statements, leaving room for unexpectedly high CPI data to be released.

This implies that a higher outcome than analysts' estimates will trigger an aggressive rise in the USD, suggesting that the Fed will comfortably remain with higher rates. On the other hand, lower-than-expected data will lead to USD selling, as it implies that the Fed may adjust to anticipate the cut to May or June, thereby affecting US Treasury bond yields and consequently the US dollar.

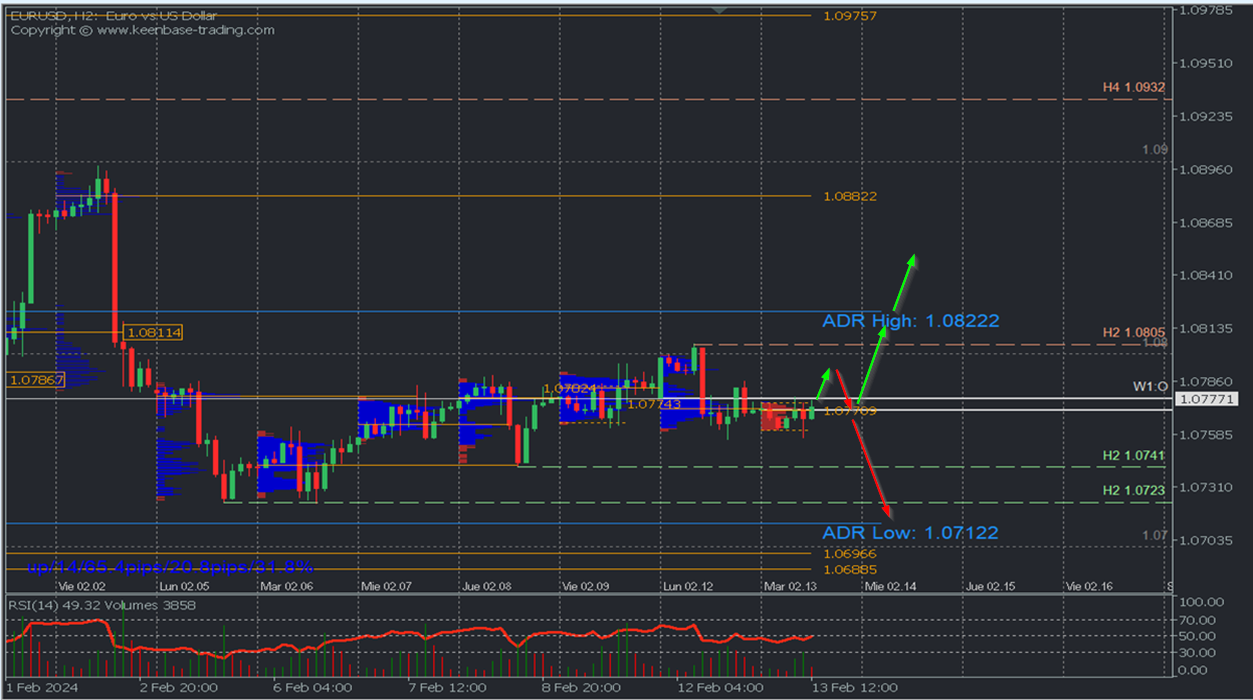

EURUSD

Trading below the weekly opening at 1.0777, just above what is considered buying zones with the Point of Control (POC) located at 1.0778, a rebound towards yesterday's high volume node at 1.0792 is expected. This is very close to the resistance at 1.0805, a breakthrough which will extend the ascent towards the daily bullish average range at 1.0822, especially with lower-than-expected figures indicating the extension of the current bullish correction.

However, this publication often generates volatile movements in both directions before the pair renews its technical downtrend sequence. This will be possible if quotes fail to break the local resistance at 1.0805 and resume selling towards 1.0741, 1.0723, and the bearish average range at 1.0714 near last week's buying zone between 1.0696 and 1.0688. This could happen with a more volatile reaction to unexpectedly higher-than-expected data.