The Greatest Investments of the last 100 years

The last 100 years has seen many significant advancements and changes in the investing world. From the rise of technology and the Internet to the creation of new investment products and strategies, investors have had many opportunities to take what the market has for them. FBS experts want to show you the most spectacular trends and broaden your market understanding with this article. You will find many references and similar patterns as the market unravels.

1960-s and Nifty Fifty

The Nifty Fifty were a group of 50 high-growth, blue-chip stocks popular among investors in the 1960s. Many of these stocks were associated with new and innovative industries, such as technology and healthcare, experiencing rapid expansion. IBM, Xerox, and McDonald’s all represented a diverse range of industries that felt amazing in the 1960-s.

They became known as “one-decision” stocks because investors were told by individuals such as University of Pennsylvania professor Jeremy Siegel that they could buy and hold them forever. However, a wise trader always knows that every asset tends to correct after a rally.

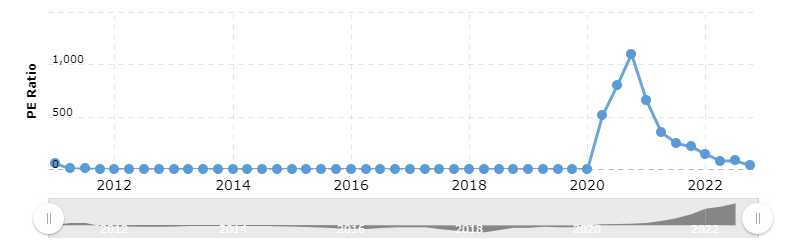

The outcome of the enormous growth in “60-s blue chips” was higher than the usual P/E ratio. This ratio shows a relation between the current market value of the company and its earnings. If the P/E ratio is too high, like Tesla had at the beginning of 2021 (1102), then investors surely overpriced the company. Compared with this, a neutral P/E in the tech industry is usually 25-30.

Tesla P/E ratio

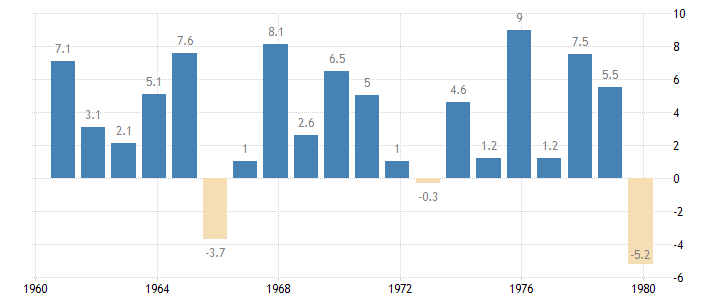

The 1970s, commodities and stagflation

The uptrend in Nifty Fifty ended at the beginning of the 1970-s, a period of the highest inflation, oil conflicts, and twofold Federal Reserve decisions.

Source: YCharts

After it, the time has come for emerging markets to step into the game. Many developing countries, such as India, experienced rapid economic growth in the 1970s, allowing investors to tap into these growth markets. For example, India showed average GDP growth of 6-7% in the 1970s, making the country one of the best performers.

Source: tradingeconomics

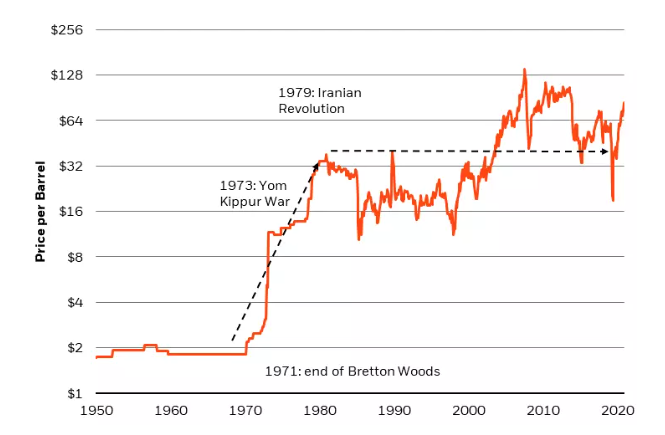

That’s not all that happened in the 1970s. The Bretton Woods Agreement pegged the USD to gold and played a significant role in the post-World War II economic recovery. However, the system began to break down in the late 1960s due to increasing global economic imbalances and the inability of the US to maintain the fixed exchange rate between the dollar and gold. In 1971, the US abandoned the gold standard, and the Bretton Woods system effectively collapsed. The end of the agreement caused the oil price to skyrocket, making it the best investment of the decade.

Source: Bloomberg, data as of October 31, 2021

One of the greatest investment ideas of the last century was the emergence of the tech industry. Many tech companies, such as Apple, Microsoft, and Amazon, have grown to become some of the largest and most profitable companies in the world. Investing in these companies early on, during their growth phase, could have resulted in significant returns for investors.

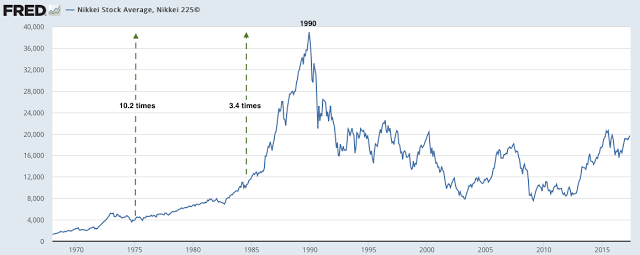

The 1980s, the rise and fall of Japan

The Japanese stock market experienced a significant rise and fall in the 1980s, with the most dramatic events occurring at the end of the decade. In the late 1980s, the Japanese stock market underwent a rapid expansion known as the “bubble economy,” driven by economic growth and speculation. During this time, stock prices soared to record highs, and the value of the real estate and other assets also rose dramatically.

However, this bubble eventually burst, leading to a sharp decline in stock prices and a recession in the Japanese economy. The stock market crash of 1990 wiped out billions of dollars in wealth and caused many companies to go bankrupt. Despite efforts to stimulate the economy, the stock market didn’t recover, and the Nikkei 225 (JP225) index is still lower than in the 1980s.

Source: FRED

The 1990s, the time before the dot-com bubble

The Internet came out of nowhere, creating hype and extolling Internet companies that people used to call dot-com companies. Investors started to overvalue all companies that worked with the Internet, and the world started to think Internet companies will continue to grow incredibly fast and won’t stop. The bubble formed by the late 1990s. During this time, the market was driven by several other factors, including a robust economy and low interest rates.

However, this bubble eventually burst, leading to a significant decline in stock prices and a downturn in the economy. Some companies, like AT&T, never fully recovered. Others, like Amazon, needed almost ten years to reach their previous all-time high. On average, the US100 index (NASDAQ) lost 83% of its market value. However, the index gained almost 3000% over the decade.

Source: tradingview

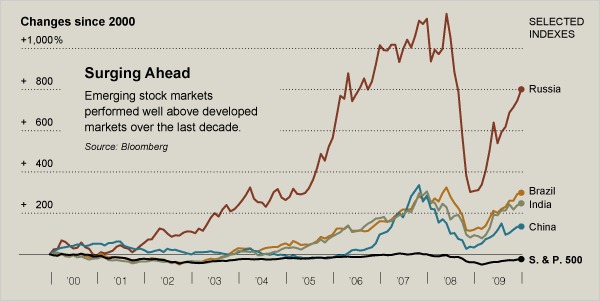

Emerging markets in the 2000s

As you can see, overvaluation is a common problem that follows the market almost every decade, leading to high risks and huge losses. History repeats itself, and in the 2000s, we witnessed another round of overvaluation. This time, emerging markets were in the limelight.

Huge flows of foreign investments went to emerging countries with higher risks and rewards. For example, Russia benefited from soaring oil prices, and its main stock gauge gained 880% over the decade, even despite the market crash of 2008.

Other high-yield markets are Brazil, with over 300% growth, India, and China. Meanwhile, the US500 index finished the decade with a loss of several percent.

Source: Seeking Alpha

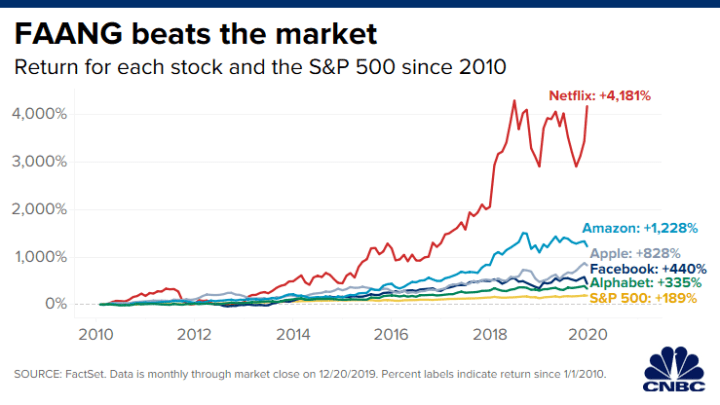

FAANG in the 2010s

One of the greatest decades for tech giants started in 2010. FAANG stands for Meta (formerly Facebook), Apple, Amazon, Netflix, and Alphabet (the “G” refers to Google). Although the acronym was first coined in the financial world, it’s commonly used in everyday vernacular to describe the major players in the American technology world.

FAANG stocks dominated the market, with its leader, Netflix, gaining over 4100% in a decade. At the same time, Apple became the first-ever company to reach a market value of $1 trillion in 2018. Later, Apple became the first company to hit $3 trillion.

These companies performed so well that retail traders now think the growth in FAANG will remain fast in the 2020s. However, the market has another opinion.

Conslusion and the 2020s

This decade certainly has a lot to show. Investment ideas are bursting through financial crises, stagflation, geopolitical tensions, and conflicts. FAANG time has passed, and other great companies and industries will rise and thrive.

Among the best investment ideas of the decade, we can think of green energy, uranium miners, blockchain technology, and emerging Asian markets like Indonesia, the Philippines, and Thailand.

Overall, the last century has seen many great investment ideas that have allowed investors to grow their wealth and achieve their financial goals. We can learn a lot from history. Most importantly, don’t forget to control your risks. It seems the best ability of all time.