Swiss National Bank Supports that Negative Rates are Necessary

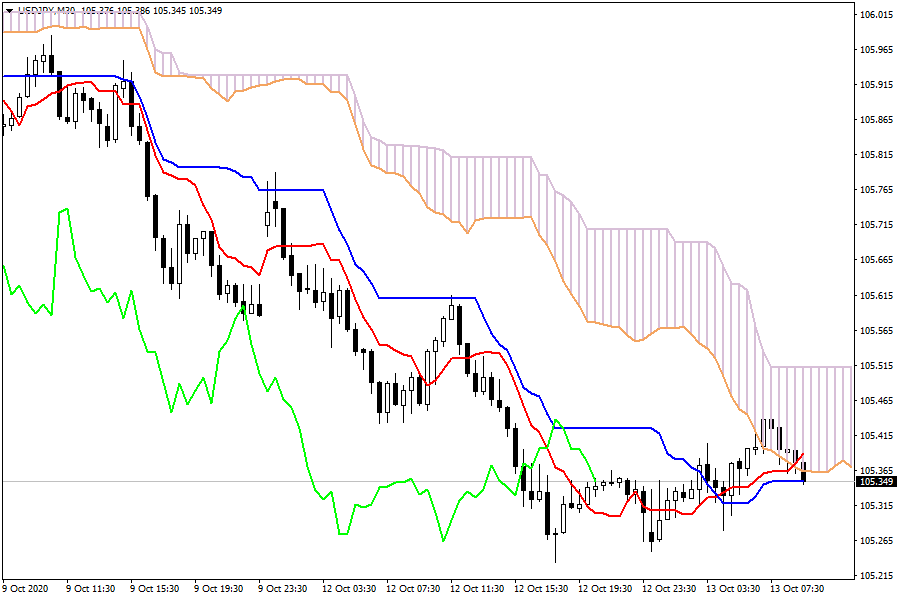

Ichimoku Kinko Hyo

USD/JPY: The pair is trading in a bearish sentiment below the cloud. The currency pair has just surpassed the Kijun-sen and the Tenkan-sen, confirming a bearish momentum.

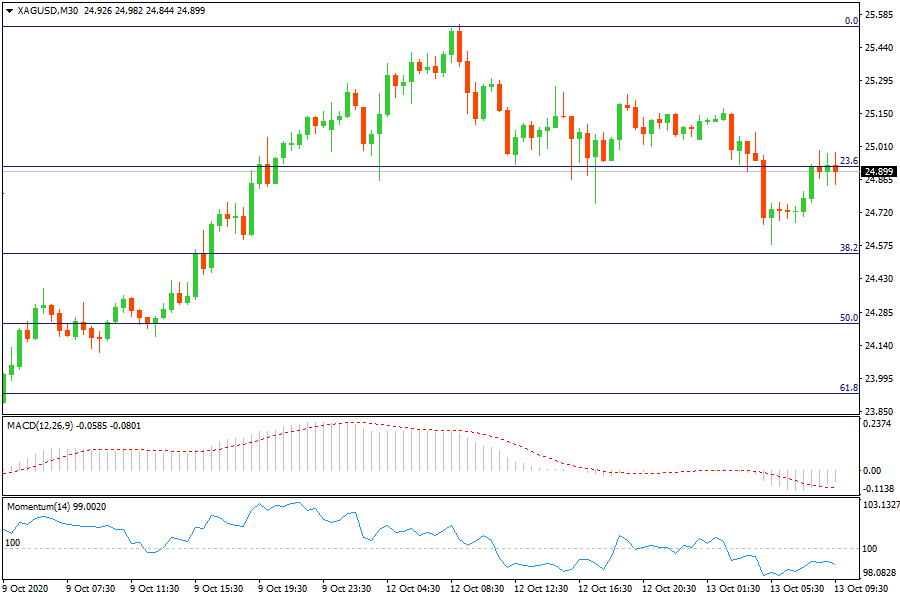

Fibonacci Levels

XAG/USD: Silver stands on 23.6% retracement area and continues to be a bullish trend.

EU Market View

European stock markets are seen opening mixed Tuesday, with investors having to sift through the conflicting impulses of strong Chinese export data and a setback in the progress towards a Covid-19 vaccine. Looking ahead, highlights from the macroeconomic calendar include German CPI (Final) and ZEW, UK Unemployment, US CPI, Fed Discount Rate Minutes, Apple Event, EU Ministers on Brexit, and Amazon Prime Day. Earlier Tuesday, official data showed that China's exports grew at a slightly faster rate in September, up 9.9% on the year last month, compared with a 9.5% increase in August. This marks a fourth straight month of gains, suggesting that a global economic recovery is underway.

European economic news was less impressive, with German consumer prices falling in September, confirming preliminary data, and the UK unemployment rate climbing to 4.5% in August, higher than expected.

EU Key Point

- ECB sources said several policymakers are reluctant to follow the Fed's Average Inflation targeting

- SNB's Jordan supports that we are not big fans of negative interest rates, but it is necessary

- Trump says that will spend more money if campaign spending is not enough

- Japan's Aso says G7 finance ministers will meet later Tuesday, issue a statement

- China September exports comes at +8.7% y/y (vs. +10.5% expected)