Stocks to trade this week

We love earnings season! And you? It’s so simple to trade stocks during this period. If the earnings are better than the forecasts, the stock will rise. In opposite, if the earnings are worse – the stock will drop. Easy! Do you know that FBS traders can make both buy and sell trades while trading stock CFDs, right? Therefore, traders have a chance to profit in either outcome. Let’s go over the main earnings releases of the current week.

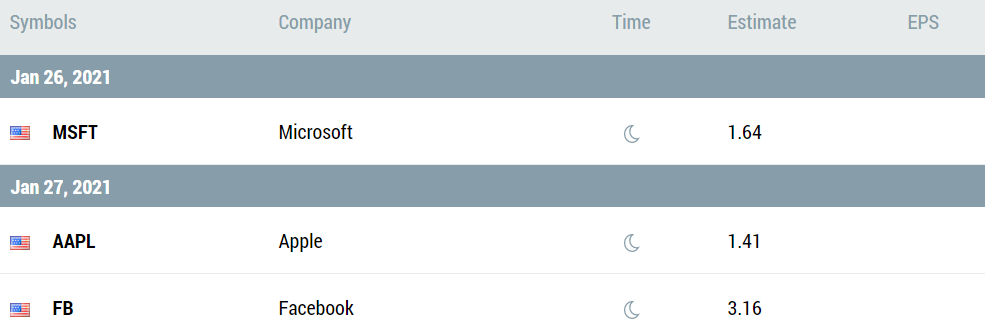

Microsoft - Tuesday, January 26, 12:30 MT time

Needless to say, Microsoft's Windows is the world's top operating system for PCs. Where is all the company’s revenue coming from? There are three main segments: 1) productivity and business (Office and LinkedIn) – 32%, 2) cloud services (Azure) – 34%, 3) personal computing (Windows licenses, Xbox consoles, and Bing) – 34%. Such diversification helps the company not only to resist the pandemic but also grow! Since the Covid-19 wanes in the US, what can we expect from Microsoft, beside the positive results?

Microsoft is trading near its all-time highs. The breakout above $232.00 will drive the stock higher to the next round number at $240.00. Support levels are at the recent lows of $217.00 and $210.00.

Facebook – Wednesday, January 27, 12:00 MT time

Expectations for Facebook aren’t so great. The first reason for the poor performance is a political backlash. Facebook and some other companies suspended Donald Trump’s account. Those actions were viewed negatively and triggered the stock’s decline. In addition, the company faces antitrust lawsuits, which call to divest Facebook of Instagram and WhatsApp, breaking it into smaller companies. It’s a tough time for Facebook.

Facebook has failed to cross the resistance of $280.00 a few time already. Therefore, we can expect the pullback to the downside again, but if earnings come better than the estimates, the way up to December’s high of $287.00 will be clear. Support levels are $265.00 and $255.00.

Apple – Thursday, January 28, 00:00 MT time

Apple is opening up new markets. While customers are enjoying new devices, investors should pay attention to Apple’s approach to services. Apple reported record revenue in 2020 due to the progress in its services such as Apple TV, iTunes, and its App Store – up 16% from 2019. Apply should surprise us with better-than-expected earnings this quarter again.

Apple is trading in an ascending channel. The breakout above the record high of $140.00 will drive the stock to the next round number of $145.00. Support levels are at the lows of January 8 and 15 at $132.00 and $126.50, respectively.

Follow earnings releases and trade accordingly!