NZD: Unemployment Rate Could Weaken NZD

Traders are closely monitoring Fed speeches, particularly Fed's Mester speech scheduled for Tuesday, for further insights into monetary policy directions. Additionally, market participants await key economic releases later in the week, including New Zealand's Unemployment Rate for Q4 and China's Consumer Price Index (CPI) and Producer Price Index (PPI) for January. These data points will provide crucial cues for assessing the economic outlook and may influence the NZDUSD pair's movement.

AUDNZD - H4 Timeframe

AUDNZD has just bounced off the demand zone on the Daily timeframe, and I suspect the price action intends to target the supply zone on the 4-hour timeframe. Although I do not have a lot of confidence in this sentiment, I, however, expect prices to get attracted to the 100-period moving average as shown on the chart.

Analyst’s Expectations:

Direction: Bullish

Target: 1.07635

Invalidation: 1.06972

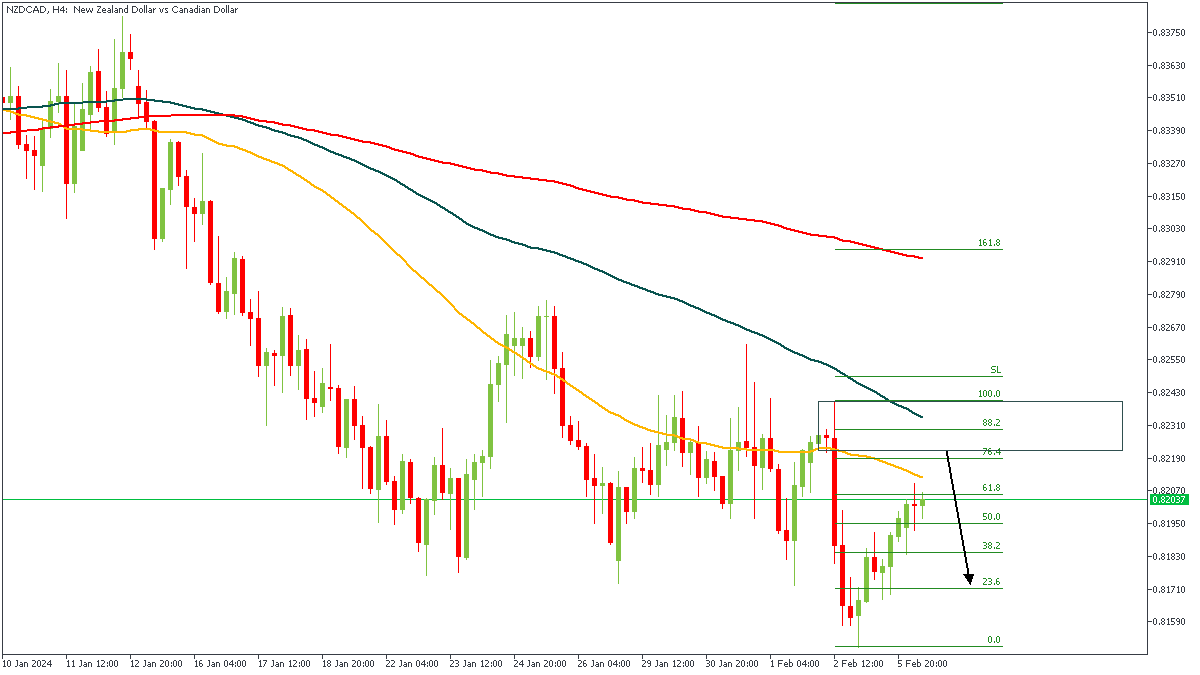

NZDCAD - H4 Timeframe

The 4-Hour timeframe on NZDCAD has been in a downtrend for a while now, as indicated by the moving averages. Following this, we see price currently approaching the 76% of the Fibonacci retracement, as well as the supply zone that lies underneath it. The bearish array of the moving averages adds an extra layer of confluence, whilst the 100-period moving average resistance is an additional factor to consider. My conclusion here is a bearish sentiment.

Analyst’s Expectations:

Direction: Bearish

Target: 0.81734

Invalidation: 0.82409

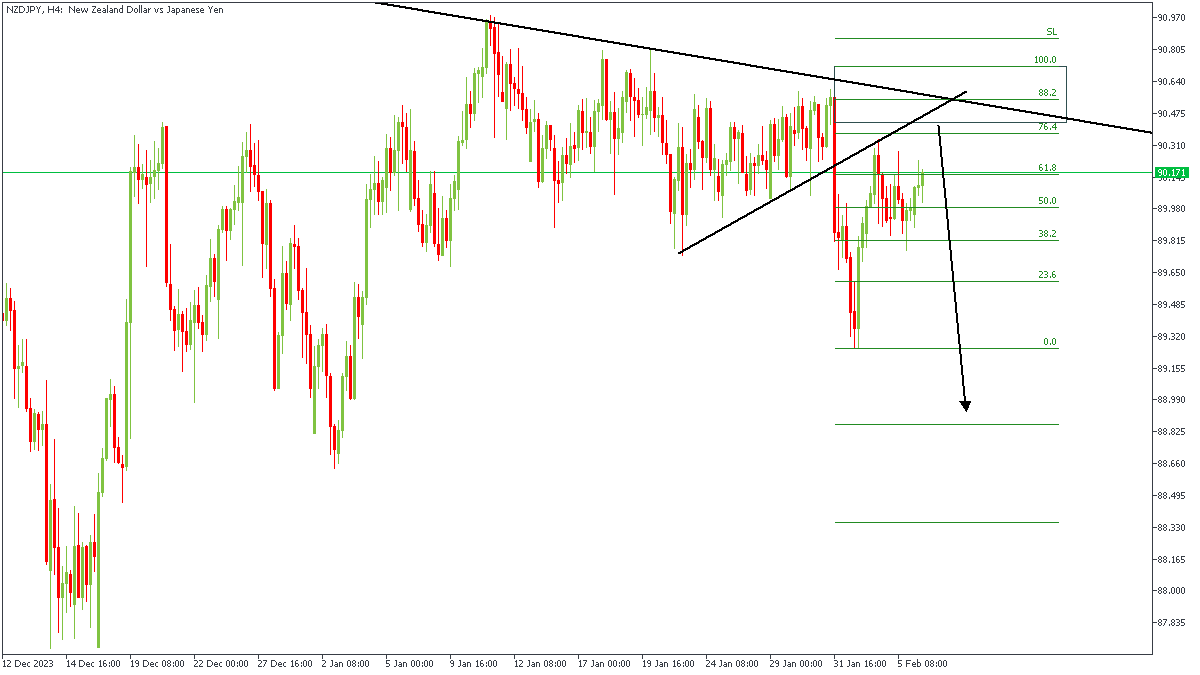

NZDJPY - H4 Timeframe

NZDJPY mirrors the price action as seen on NZDCAD, albeit with a few minor differences. In the case of NZDJPY, we see price currently approaching the 76% of the Fibonacci retracement as well, however, there is a confluence of two resistance trendlines, as well as the supply zone serving as the additional confirmations of the bearish sentiment in this case.

Analyst’s Expectations:

Direction: Bearish

Target: 89.620

Invalidation: 90.731

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.