Nasdaq, S&P 500 Reach Record Highs

After creating record highs, Wall Street's main indexes opened on Wednesday and began to edge lower, reflecting cautious sentiment among investors. They're eagerly awaiting crucial inflation data that could impact the U.S. Federal Reserve's interest rate decisions. The upcoming release of the personal consumption expenditures (PCE) price index is expected to show a rise in prices for January. Despite recent excitement over strong earnings and advancements in artificial intelligence, the stock market has faced challenges in the past few days. Persistent inflation concerns, along with evidence of a strong U.S. economy, have led traders to adjust their expectations. Many now anticipate the first rate cut to occur in June, reflecting uncertainty about inflation and the Fed's response.

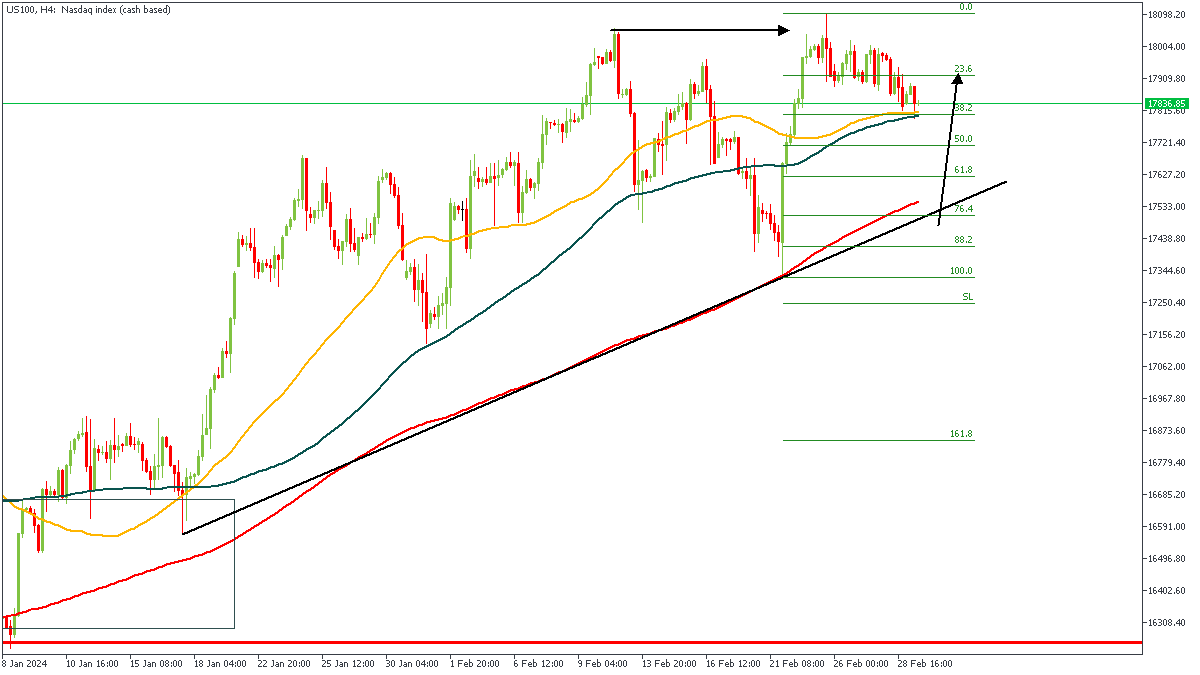

US100 - H4 Timeframe

US100 recently created a record high around the 18,100 price mark, after which we saw a sluggish decline; which seems to still be in place at this time. However, considering the recent break above the previous high, and the bullish array of the moving averages, it is quite clear that the market sentiment still remains bullish. So, combining this sentiment with confluences from the trendline support, demand zone, and Fibonacci levels, I am convinced that price may resume its bullish outlook soon.

Analyst’s Expectations:

Direction: Bullish

Target: 17,915.54

Invalidation: 17,310.77

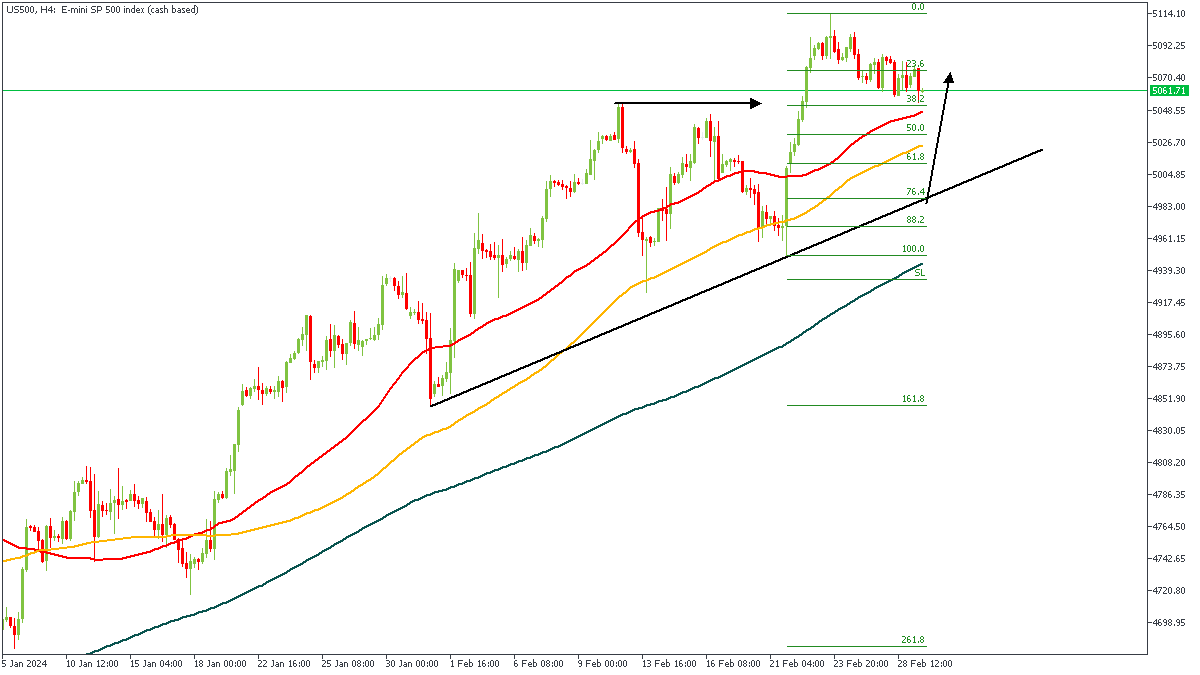

US500 - H4 Timeframe

In the same vein as we saw on the US100 chart, US500 recently created its own record high at the 5114.38 price area, following which we saw price slip lower towards the demand zone that caused the break of structure. The bullish array of the moving averages, the trendline support, drop-base-rally demand, and the Fibonacci levels lend credence to my expectation of a bullish outcome in the nearest future.

Analyst’s Expectations:

Direction: Bullish

Target: 5074.68

Invalidation: 4946.10

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.