GBP: What to Expect From CPI

In November, average pay growth in the UK slowed to 6.5%, down from 7.2% in the previous month, according to the Office for National Statistics. This decline suggests that inflationary pressures have weakened more than anticipated. The decrease in pay growth came as the UK jobs market weakened due to high interest rates and stagnation across much of the economy. Job vacancies also fell at the fastest rate on record in December, indicating a further cooling of the UK labour market. The drop in wages growth, however, was accompanied by falls in inflation, meaning real wages grew for the fifth consecutive month, easing pressure on household incomes. Despite the decline in pay growth, the overall jobs market remained stable, with employment only marginally down and the unemployment rate unchanged at 4.2%.

GBPCAD - D1 Timeframe

The Daily timeframe of GBPCAD shows price currently being rejected from the trendline resistance, and the supply zone. As a result, I expect to see the price action slide towards the moving average for support. In the meantime, I will be waiting for an entry from the lower timeframes before taking a shot at it.

Analyst’s Expectations:

Direction: Bearish

Target: 1.69092

Invalidation: 1.70940

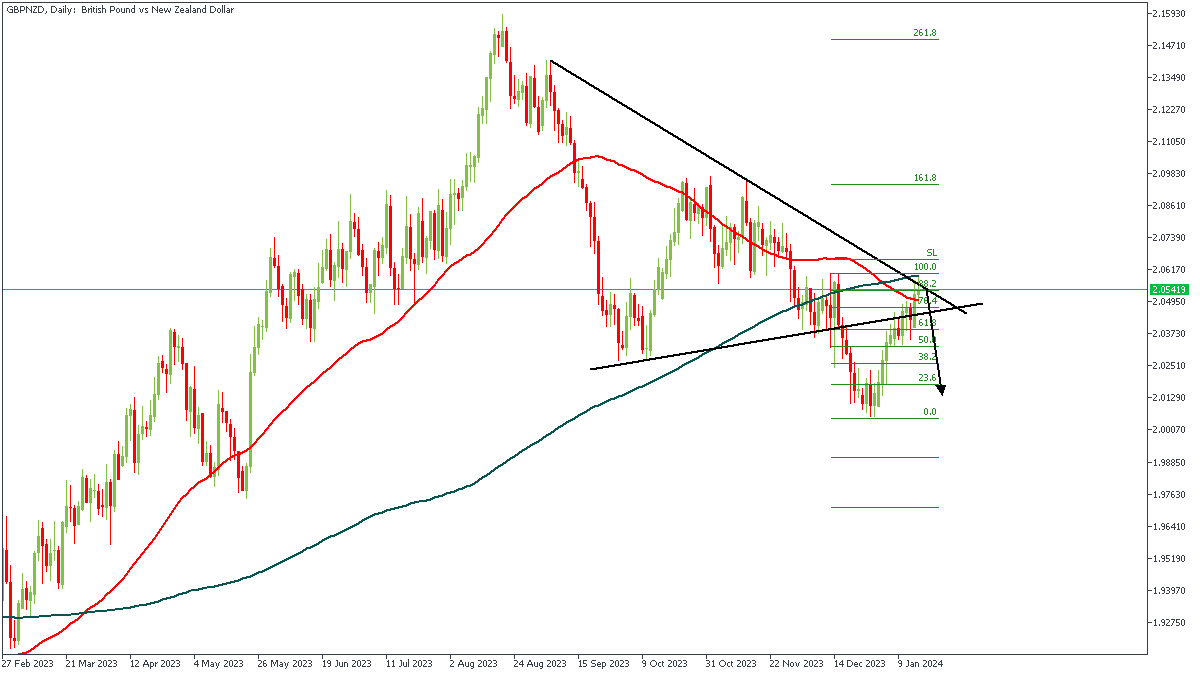

GBPNZD - H4 Timeframe

GBPNZD is currently trading between the 50 and 200 moving averages. The 200 moving average overlaps with the resistance trendline, and the moving averages are also arrayed in a descending order. Considering the confluence from the Fibonacci retracement levels, I will be positioning for a short entry with a target at the 23% of the Fibonacci retracement level.

Analyst’s Expectations:

Direction: Bearish

Target: 2.04375

Invalidation: 2.05870

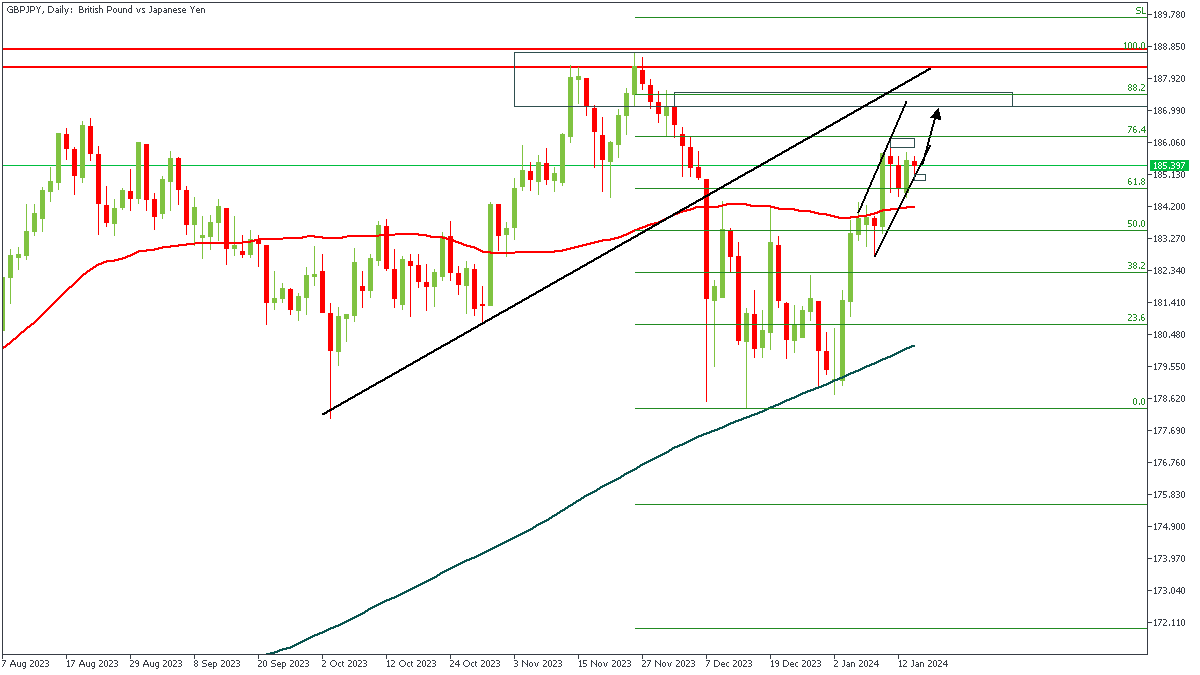

GBPJPY - D1 Timeframe

After breaking below the trendline support, the price action on GBPJPY seems to be retracing its steps in order to complete a retest of the supply zone and the QMR pattern. The supply zone on the Daily timeframe overlaps the 88% of the Fibonacci retracement zone, while the current consolidation within the channel is also a sign that the price action is seeking out a key zone from which it can react properly.

Analyst’s Expectations:

Direction: Bullish

Target: 187.054

Invalidation: 184.763

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.