GBP Might Strengthen as GDP Posts Positive

On Friday 10th February 2023, the Office for National Statistics published the figures for the Gross Domestic Product (GDP) as 0.1% which turned out greater than the initial forecast of -0.2%. As a result of the positive outlook of this report, we need to examine the short-term impact on GBP pairs from a technical point of view.

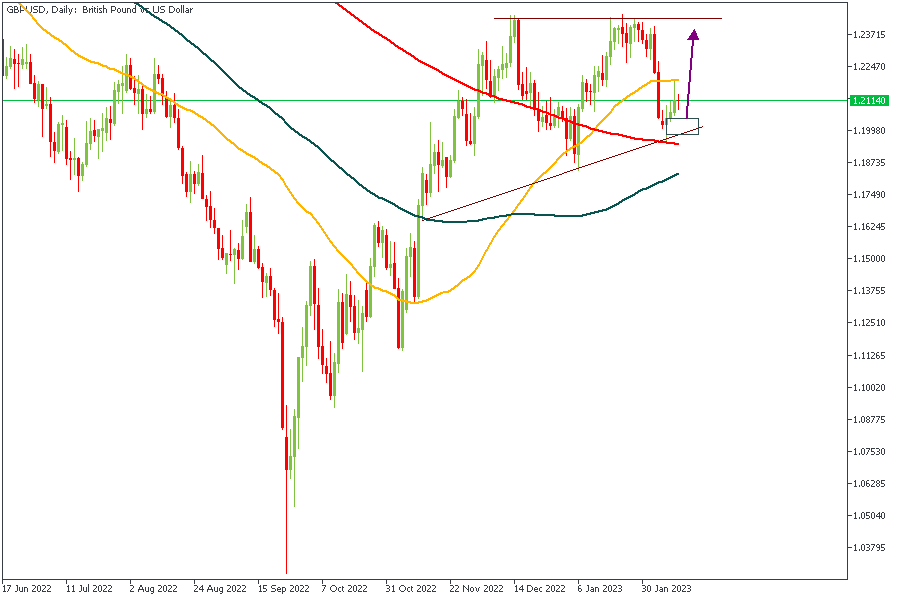

GBPUSD

GBPUSD is currently reacting from the confluence of the trendline support, the 200-Day moving average, and the 88% Fibonacci level. Also, since the 50-Day moving average already crossed above the 100 and 200-period averages, there's a huge chance we get to experience some bullish price action all the way to 1.24854 or higher.

Analysts’ Expectations:

Direction: Bullish

Target: 1.24854

Invalidation: 1.19492

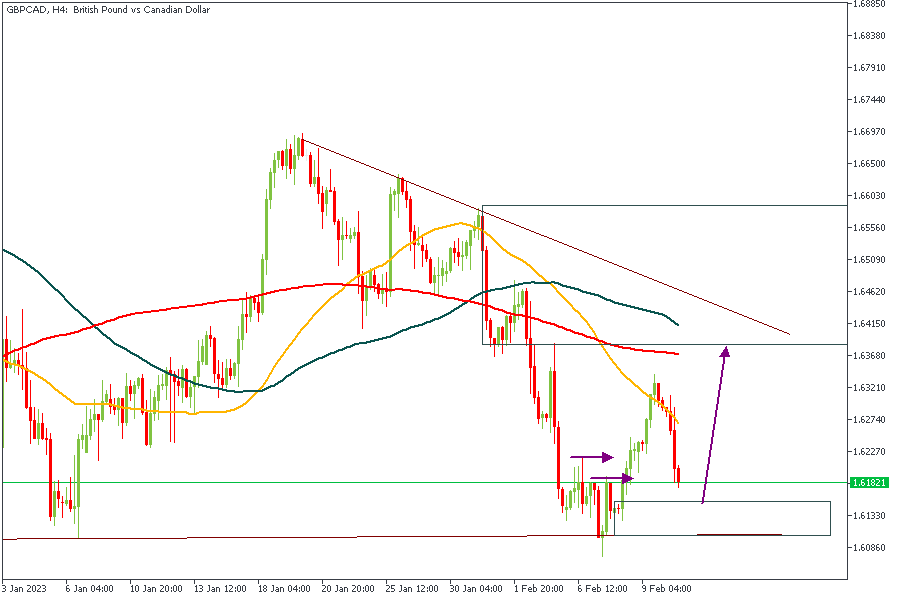

GBPCAD

Despite being in a downtrend, GBPCAD can be seen to have broken above two previous highs. This indicates the possibility of a bullish reaction from the highlighted drop-base-rally demand zone. I personally expect a typical case of a buy-to-sell movement to come into play in this scenario.

Analysts’ Expectations:

Direction: Bullish

Target: 1.63470

Invalidation: 1.60654

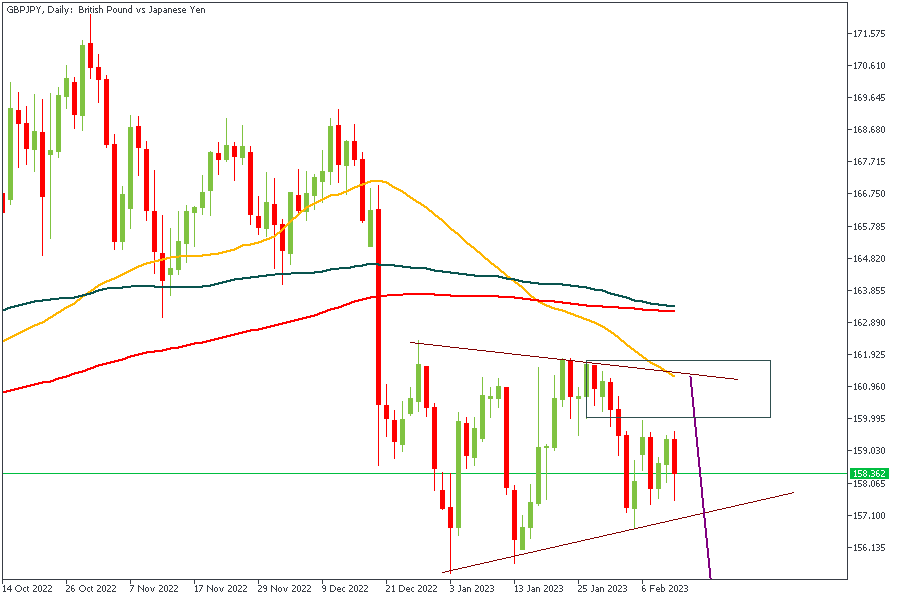

GBPJPY

GBPJPY has recently created a wedge pattern, and within this wedge the most recent price action has been a bullish reaction from the trendline support, leaving us with the option of a bearish rejection from the rally-base-drop supply zone. The 50-Day moving average acts as an additional confluence to validate our prediction.

Analysts’ Expectations:

Direction: Bearish

Target: 156.21

Invalidation: 161.908

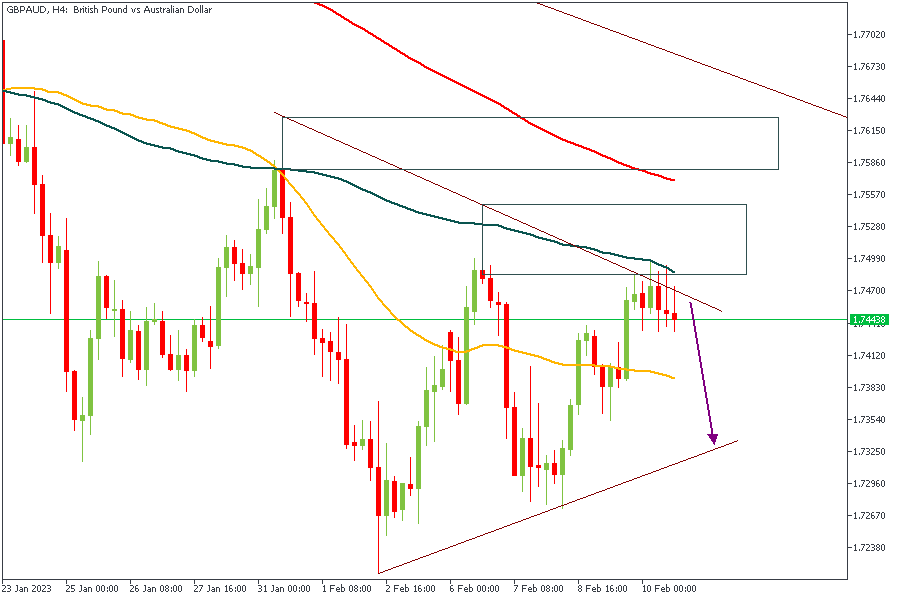

GBPAUD

GBPAUD is currently reacting from an area of supply. The 100-period moving average and the trendline resistance are an added confluence for the bearish price action since price is currently constricted within a wedge pattern.

Analysts’ Expectations:

Direction: Bearish

Target: 1.73278

Invalidation: 1.75482

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.