Forex, Gold, Oil, and Stocks: What to Trade on July 25-29?

As central banks raise rates amid recession fears and companies deliver financial results, markets are super active and provide multiple trade opportunities. Let's see what awaits traders this week!

Forex: all eyes on USD

The European Central Bank increased rates by 50 basis points on Thursday. That was the first rate hike in 11 years and the biggest since 2000. EURUSD initially jumped to 1.0270, but the advance was short-lived as another drama shook the battered single currency. Italian Prime Minister Mario Draghi resigned, opening the way for an emergency election and possibly a more eurosceptic government. Now all eyes turn to the upcoming meeting of the US Federal Reserve on Wednesday, July 27. The Fed is expected to raise rates to tame inflation, although opinions differ on whether we'll see a 75- or 100-point increase. There can be no doubt that big moves will shake the Forex market. EURUSD can still make another step to parity given the uncertainty about the Eurozone's economic future.

In the meantime, if the Fed underdelivers and highlights the recession risk, USDCHF may test support at 0.96 and 0.95.

Oil & Gold await the Fed

Brent oil stayed inside the downtrend channel from June highs. Softening demand in the US weighs on the price. However, supply tightness and geopolitical tensions still make traders buy oil on the dips. As long as XBRUSD stays above 96.50, it will keep trying to get to 105.00 and 110.00. Gold made a detour to $1680, the lowest level since March.

The prospect of a further rise in interest rates continues to drive flows away from the metal. Above 1730, XAUUSD can get to 1760. The next levels to watch on the upside will be 1780 and 1800. Notice, however, that it's more about selling on rallies these days.

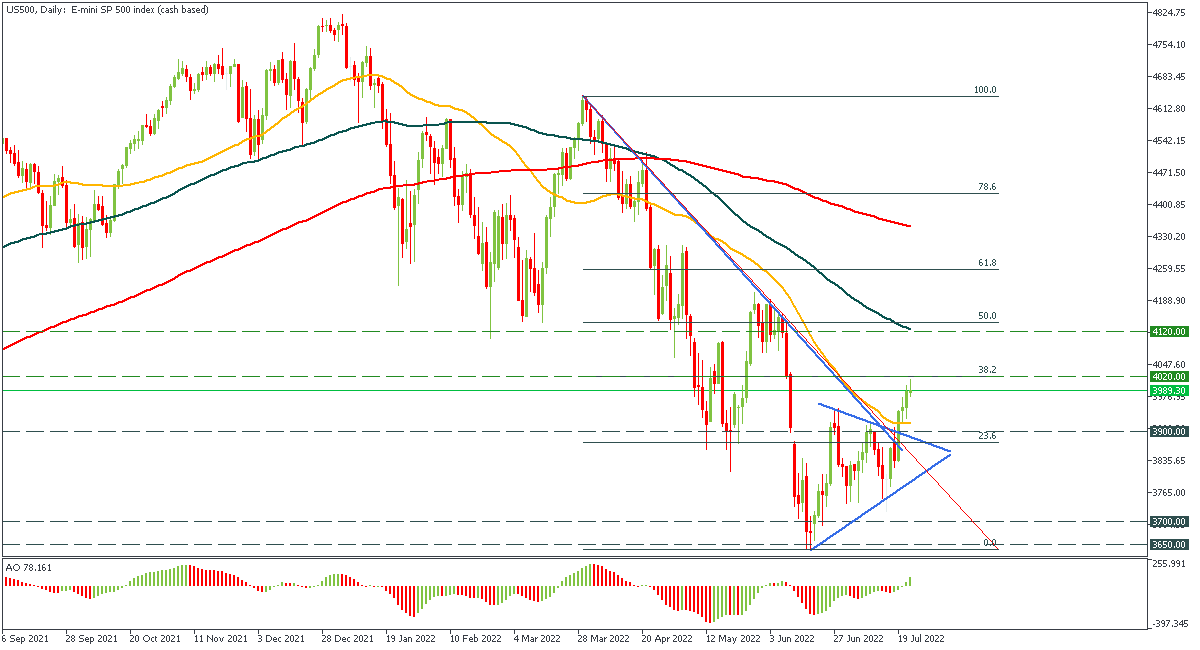

Earnings season continues for stocks

The US stock market had a good week. Some analysts think that US500 has already put the worst behind, but much will depend on the Fed's meeting outcome. Guidance will be essential, and any softening in the rate hike outlook would be great for global growth, oil, and stocks. It's also necessary to follow Joe Biden's Covid developments.

Meanwhile, the second-quarter earnings season continues. Netflix stock managed to gain 15% as the decline in subscriptions turned out to be lower than expected. Next week we'll hear from Microsoft, Meta, Apple, and other big companies, so get ready to trade on these stocks' price swings.