Equity Markets Outlook

The stock markets are usually considered indicators of the strength or weakness of a country's economy. Therefore, many traders review indices as a leading indicator of what to expect from large economies around the globe. Let's look at a few of these without further ado.

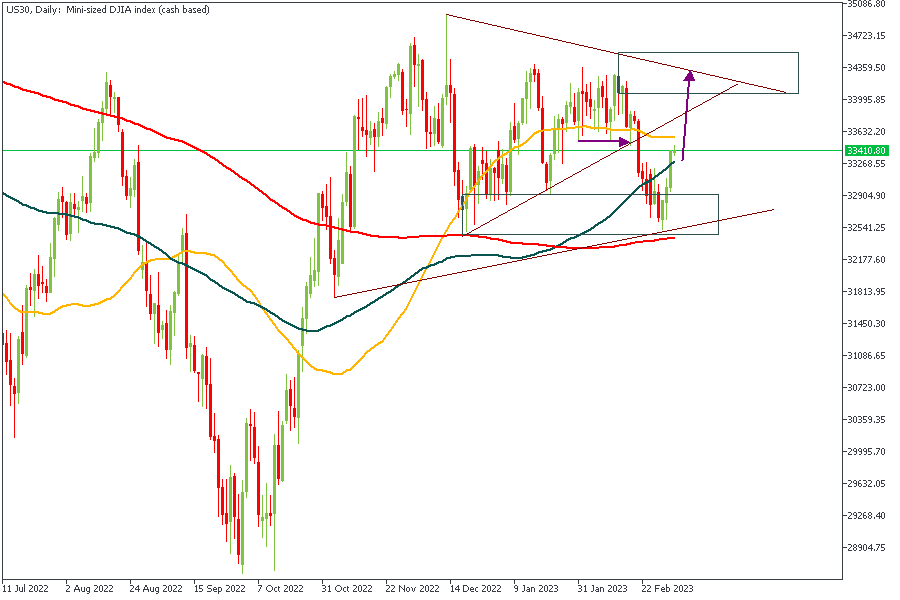

US30

The US30 is trading inside a wedge pattern on the daily timeframe. The price has recently bounced off the demand zone that overlapped the 200-period moving average. From the positioning of the moving averages, the sentiment is bullish. The primary target area would be the supply zone at the resistance trendline of the wedge.

Analysts’ Expectations:

Direction: Bullish

Target: 33 996

Invalidation: 32 541

US500

The trend on US500 is currently contracting and has thus created a wedge pattern. We have seen that the 50 and 100-period moving averages are currently above the 200-period MA, implying a bullish sentiment. Working with this sentiment in mind means that the initial price target would be somewhere around the supply zone, just below the trendline resistance of the wedge pattern.

Analysts’ Expectations:

Direction: Bullish

Target: 4153

Invalidation: 3961

HK50

HK50 has reacted quite powerfully to the supply zone, as we can observe from how far the price dropped from the zone. However, I expect we will see some bullish reaction from the current area based on the crossing of the 50-Day moving average above the 100 and 200 moving averages. Additional confluences include: · the 88% of the Fibonacci retracement· 200-moving average as a support · the break above the previous high at 20100.

Analysts’ Expectations:

Direction: Bullish

Target: 22 000

Invalidation: 19 500

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.