DAX30: steady for now?

The German index has been following the scenario of the world equities. The recovery which started in March now reached a crucial point at 11,200. The index has already made several attempts to break this level, but the muted risk sentiment was limiting bulls’ ability to overpass it. How high are the chances of a breakout?

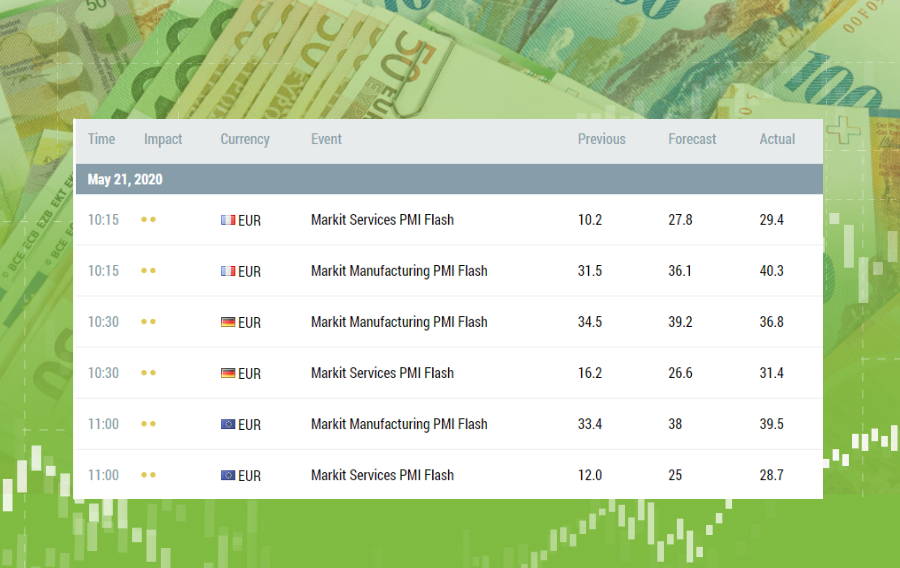

Eurozone data: signs of recovery

The European indicators surprised us positively during the last two weeks. While the surplus of the European trade balance increased by 23.5B (vs. 17.2B expected), the PMI releases on May 21 also showed better figures than analysts’ expectations. They indicate that purchasing managers in Europe become more optimistic about business conditions. There are actual reasons behind this improvement: the European economies are slowly awakening while easing the restrictions caused by a coronavirus.

However, better economic performance has done little for the European stock market and the DAX30 in particular. The overall cautiousness rules the market with fresh risks caused by US-China tensions and the fear of the second wave of Covid-19.

The technical picture

On the daily chart, DAX30 continues moving within an ascending trading channel. The index bounced off the 11,200 level and started the trading session on Friday with a gap down. Given uncertainties and the absence of important economic indicators for the Eurozone, the index may continue trading close to this level at least until the end of May. In case of positive news (for example, vaccine's approval), buyers will rush above 11,200 towards the next resistance at 11,400. The correction to the downside may be a lucky chance for bears. They will be looking for a test of 10,500 – a lower border of the ascending channel. The next support for them will be placed at 10,200.

DAX30 is traded as CFD futures contract in MT4 and MT5. You need to choose DAX30-20M in order to open a position.