Be Ready to Sell AUD

What is happening?

The Reserve Bank of Australia will hold a meeting on August 3. Analysts believe the bank may increase its quantitative easing program, while other banks are lowering their bond buys or discussing this decision.

Why?

Australia is poorly coping with the new Covid-19 wave. Sydney's current lockdown is expected to end on August 28 and there are some rumors that it might be extended. Five weeks of lockdown haven’t helped – infections continue to spread.

What to expect?

Westpac, an Australian bank, claimed that the RBA may lift the purchase pace from 5 billion Australian dollars to 6 billion. If the bank increases asset purchases, it may surprise the markets and send the AUD down.

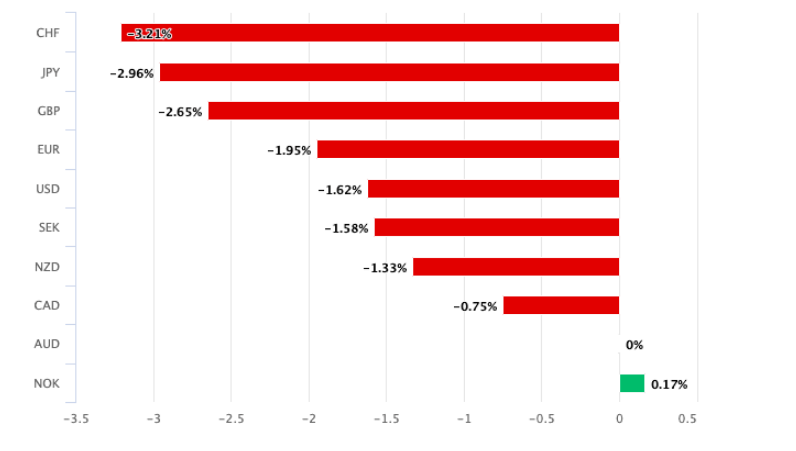

The AUD has already weakened. It has dropped against all major peers in July! Just look at the chart.

Source: https://www.poundsterlinglive.com/

Forecast

AUD/USD is forecasted at 0.73 at the end of 2021 by Wells Fargo, 0.74 by the end of March 2022, 0.75 by the end of June 2022, and 0.76 by the end of September.

Tech tips

AUD/USD is moving inside the descending channel. However, it has been stuck in a range between 0.7340 and 0.7400 since July 21. It’s touching the upper trend line now, therefore the pair is likely to reverse down. If it drops below the 0.7340 support level, it may fall to the low of July 20 at 0.7300. Resistance levels are high of July 29 at 0.7400 and the next round number of 0.7450.