AUDUSD hits 9-month low Ahead of the Unemployment Rate

The Reserve Bank of Australia (RBA) has opted to keep interest rates steady at 4.1% for the second consecutive month, signaling a new phase in its approach to tackling inflation. The RBA's governor, Philip Lowe, referred to this stage as the "calibration phase," where the central bank makes subtle adjustments to its policy. Despite rising unemployment to 4.2% and an annual inflation rate of 6%, the RBA believes its past rate hikes will continue to curb inflation. The RBA's strategy involves gradually allowing previous interest rate changes to impact the economy. While further rate hikes are possible, they would likely be delayed until later in the year.

AUDUSD - D1 Timeframe

After a record swoop in the price action, the AUDUSD might be prepping for a rebound. The current price action on AUDUSD suggests that the marked demand zone on the attached chart would be the major turning point in the price action as we await the fundamental confluence in line with this sentiment. In the meantime, the confirmations for this trade include;

- Trendline support;

- Pivot zone on the daily timeframe.

Analyst’s Expectations:

Direction: Bullish

Target: 0.66323

Invalidation: 0.63872

GBPAUD - D1 Timeframe

GBPAUD is trading within the weekly supply zone, having recently broken above the trendline resistance. I believe the break above the trendline is simply an induced move to trap sellers and shake off several of them before the bearish move actually begins. On this basis, I will be waiting to see a clear entry condition on the lower timeframe due to a change in the market structure before I take an entry.

Analyst’s Expectations:

Direction: Bearish

Target: 1.93961

Invalidation: 1.98973

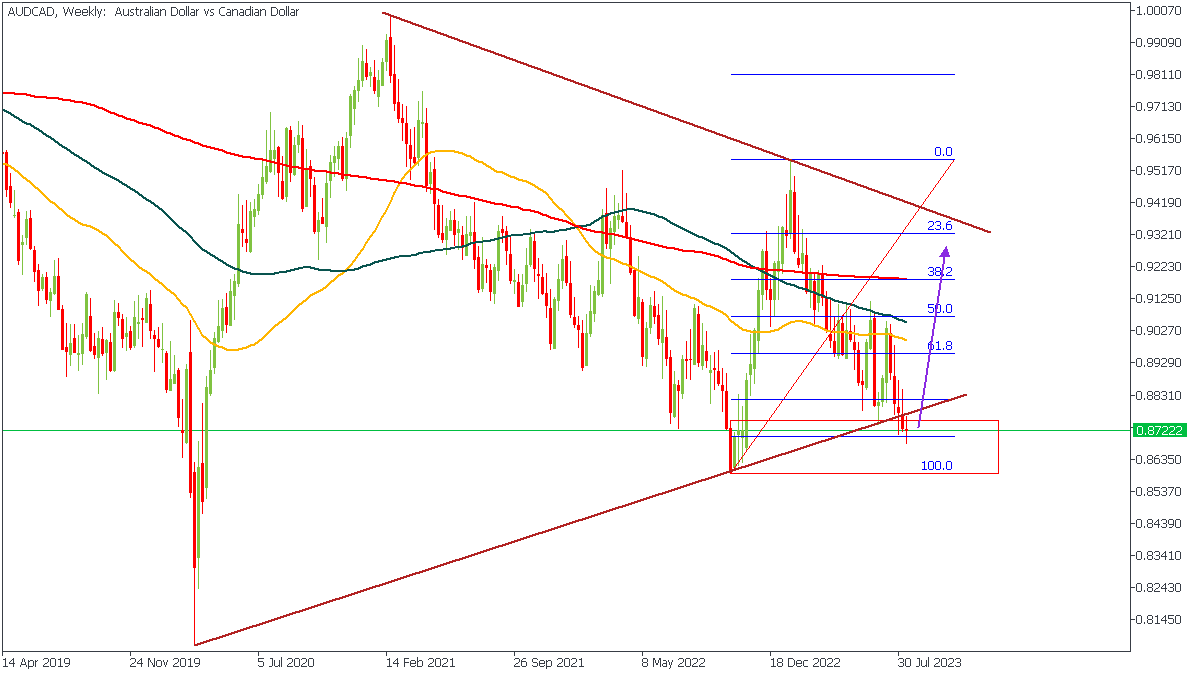

AUDCAD - W1 Timeframe

AUDCAD has a few confluences that clearly state the market intent as bullish. First, the price currently trading within the demand zone from the previous low. This movement is also supported by the trendline support and 88% of the Fibonacci retracement tool. In this regard, a structural confirmation on the lower timeframe would trigger to go long.

Analyst’s Expectations:

Direction: Bullish

Target: 0.89023

Invalidation: 0.85948

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.