AMAZON stock: brace yourselves

The unbearable lightness of being

It’s interesting how literally opposite forecasts are interpreted to bring the same result for Amazon. As if there was nothing else in the basket of options but success and success for this stock. Look at this: one agency says that Amazon’s stock may rise, that’s why you should buy it; another one says the company may display shortage of earnings – still buy it! Well, the extreme left one refers more to divorce agreements between Jess Bezos and his ex-wife, but probably if there was enough space in the text line, it would still say “go buy it!”.

Two particularities

There are two particularities about the recent price movement of Amazon stock.

First, although it is generally on a rising curve, July-August 2019 made it reduce its appetite and start all over: the stock reached $2,036 during the summer and then slumped. Until October, the picture was not very bright for investors – not tot say scary: losing more than $200 per share, the price dropped to $1,700. Analysts commented that it was due to earnings falling short of expectations for the preceding quarter, higher competition and certain problems with third-party sellers. However, even seeing that fall, many said that it would go back again just fine – which seems to be happening now.

Good report

However, the October 24 report brought good news about the strong performance of the company in the second quarter. Consequently, the stock gained value: the selected area in the daily chart is the reaction of investors to the earnings report. A rise of $50 in one day – certain people must have become significantly richer on that day. And that’s not only Jeff Bezos.

Did you read the second paragraph?

It said there were two particularities about this stock; one was the slump of summer 2019, the second one was missed - hopefully, you were following the line. Anyways, the second particularity is that this stock is very volatile. As you can see, it easily fluctuates by $100 across a month, so be careful. In fact, that’s the main message here – be careful. In the mid-term and long-term, there is little reason – so far - to doubt the uptrend for Amazon’s shares. But if the report on Q4’2019 disappoints the market, be prepared. Also, be prepared to read into it – it’s all in the details. Another one of these details, a technical one, is a head-and-shoulders pattern visible at the end of the chart – that’s just to add into the mosaic of interpretations for this stock.

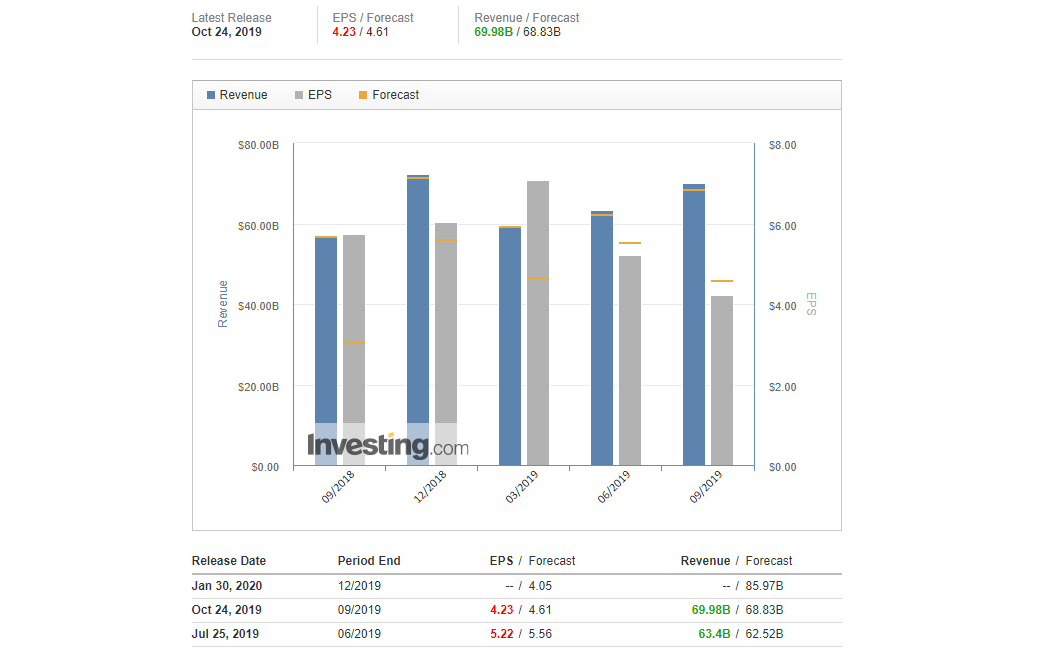

Look at this: both the Q2 and Q3 reports announced higher-than-expected revenue and lower-than-expected EPS. However, the reaction on the July report – you saw it. While October 2019 – you also saw it: in opposition, it brought an upswing. Technically, both reports presented a lower EPS and higher revenue, but one cut the stock in half (metaphorically), and the second one made it take off.

Where do I sign

Amazon will report its earnings in the fourth quarter of 2019 on January 30, at 11:30 MT time. Hopefully, you already downloaded MT5 and prepared your positions. We will keep you updated.

Just in case

If you are interested – many say that a healthy price-to-earnings ratio for a stock should be around 20. If it is much higher, a stock may be considered overvalued. For Amazon, it is around 82.